What happens to my credit score when I pay off all my debt?

This question came up in the Our Debt Freedom Family Facebook group recently, and I know a lot of people have the same question when getting out of debt.

So in this article we’re going to be answering the following question:

“How does being debt free affect your credit? We’ll be paying off our debt soon. When we do, we’ll keep our credit cards open, but what will my credit score look like when all the other loans are closed?”

A similar question was asked last year about how your score is affected when you close out one of your old credit cards. I wrote an article in response, and in that article, I went into great detail about how your credit score is calculated and how closing out the card affects your score.

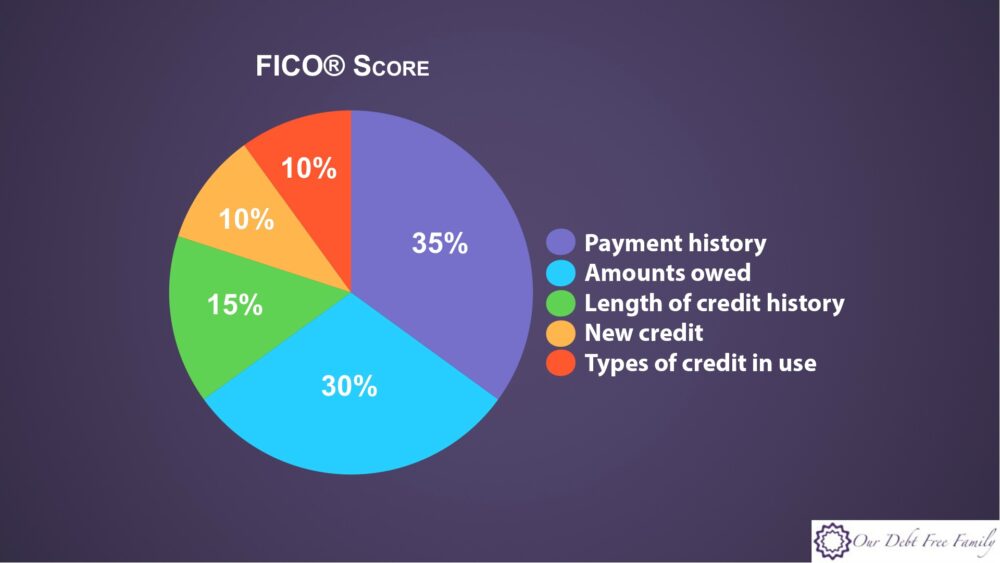

To summarize, the most commonly used credit score is calculated using software created by the Fair Isaac Corporation, also known as FICO. Your FICO® score is determined and weighted by the following five factors:

- Payment history — approximately 35%

- Amounts owed — approximately 30%

- Length of credit history — approximately 15%

- New credit — approximately 10%

- Types of credit in use — approximately 10%

However, if you leave your cards open and use them once in awhile and keep them paid off, your credit score is likely to be very high.

In fact, I recently interviewed Christine Odle who paid off $500,000 worth of debt (house and everything) since 2009. She said that she has one credit card that she pays off several times each month, and her score is over 800.

My husband and I also have one credit card that we use and pay off each month (in addition to our mortgage) and our credit scores are over 800, as well. We’ve definitely seen our credit scores increase as our debt total has decreased over the past few years.

My question to anyone else concerned about their credit score is this —

Once you’ve paid everything off, do you plan to use credit again in the future? If not, then it probably won’t have much affect on your life. But if you do, it might be worth using a credit card and paying it off every month to keep that good payment history on your record.

Don’t Pay To Check Your Credit!!!

You used to need to pay to check your credit score. Don’t do that!! Instead, get your credit score for free. Here are four completely free ways to check your credit score.

Annual Credit Report. Federal law says the three credit reporting bureaus must provide customers with a free credit report once per year. Just go to www.annualcreditreport.com and sign up.

Chase’s Credit Journey. Chase will not only provide you access to your credit score, but also gives you a set of great tools to improve your credit score. It is 100% free to sign up.

Lexis Nexis. Another way to get a free credit report is to get your Lexis Nexis file. The report will have personal information gathered from public records and third party sources. You can get a copy of what information about you they have on file by sending in an application with your ID.

More Of Our Popular Articles

Get financially fit and read our most popular articles:

Easily Save Money With Paribus

Ron and Thu Paid Off $137,000 in 4 Years

Read How In Just 7 Years Alice and Scott Paid Off $200,000 In Debt

You Can Pay Off Debt When You’re Behind On Your Bills

Keep moving forward toward your goals. You really can live the life you dream about!

Very informative post, Monica. I really appreciate the visual outline of what goes into a credit score.

Glad you liked it, Renée! Thanks for checking it out!

Ooh I hadn’t even thought of this! Love all of the detailed info you include. Thank you!

Thanks, Marlynn! Glad you found it helpful. 🙂

Interesting to see what goes into the credit score!!

I agree. With amounts owed covering 30% of the score, that explains why we’ve seen such a bump in our credit scores since paying off huge amounts of debt.

Hi Monica, Awesome blog post. I have loved seeing your progress throughout this journey. It’s always fun catching up on how things are going with you.

Thanks, Rachel! Glad you liked it!

Thank you so much! Your knowledge has been very helpful! Although we hope to never finance anything again, we do want to keep our scores high just incase. Life throws so crazy curve balls and having that safety net really helps. We will be purchasing our first house in just a few months and starting to contribute to a retirement fund. At the age of 26, we are very very fortunate.

Yay! I’m so glad you’ve found what I share helpful. 🙂 I hear you on the “just in case.” You never know what life will bring your way, and even if we plan ahead with a well-funded emergency fund, there may still be a time when it’s not enough. I’m so excited for you and your family to experience debt freedom and start your new life as homeowners!