8 Things You Should Never Carry in Your Wallet

Your wallet is a daily companion, holding everything from your cash to your ID. While it’s tempting to stuff it with as much as possible for “just in case” moments, there are certain items that don’t belong in your wallet. Overloading your wallet with unnecessary items not only makes it bulky and difficult to carry but also exposes you to risks like theft, loss, and identity theft.

In this blog, we will explore eight things you should never carry in your wallet. By eliminating these items, you can streamline your wallet, keep your personal information safe, and make it easier to find the things you truly need.

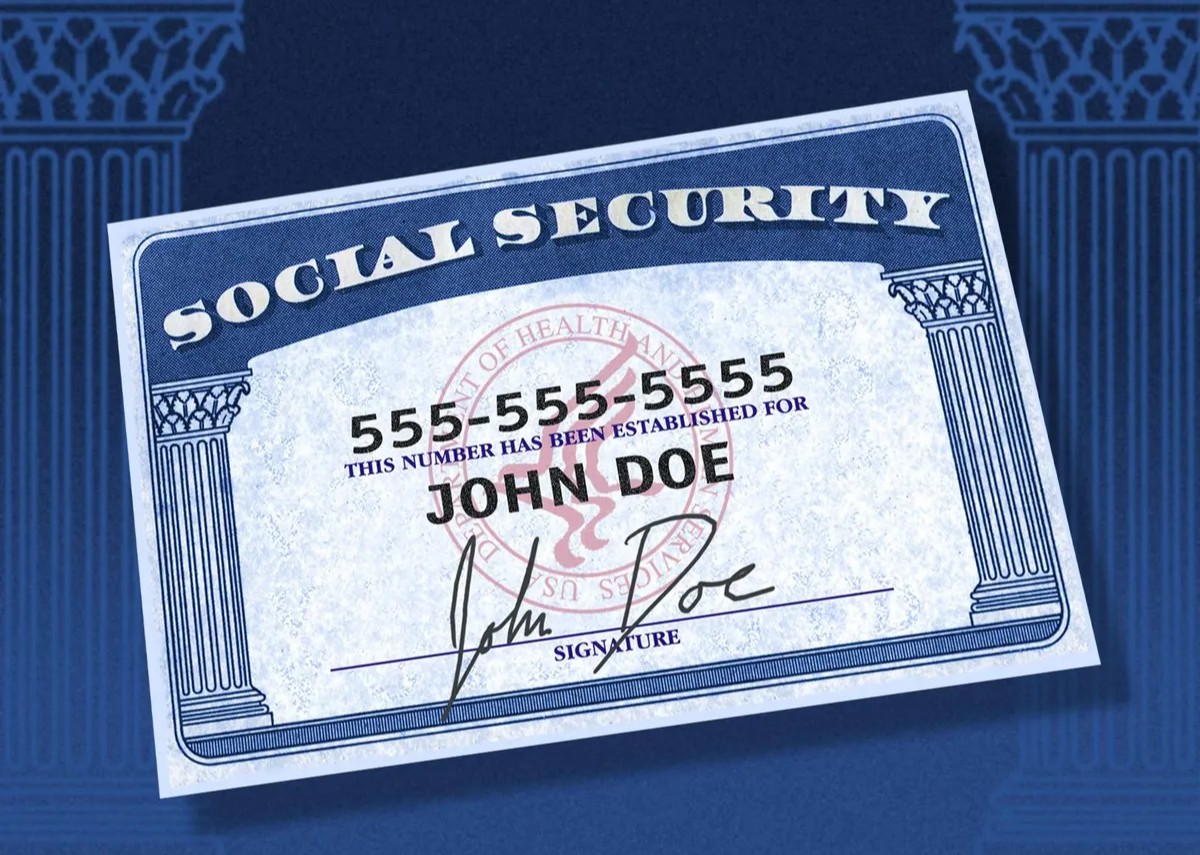

1. Your Social Security Card

Your Social Security card is one of the most important documents you own, but it’s also one of the easiest to misuse if it falls into the wrong hands. Carrying your Social Security card in your wallet is a bad idea because if your wallet is lost or stolen, someone could use it to commit identity theft. It’s important to store your Social Security card in a safe place at home, not in your wallet. If you need it for a specific purpose, such as applying for a job or opening a bank account, take it with you only for the duration of the task. Once you’re done, put it back in a safe location.

In addition to the security risks, carrying your Social Security card daily is unnecessary. Most of us rarely need it, and there are other ways to prove your identity without it. By leaving your Social Security card at home, you reduce the chance of it being lost or stolen.

2. Passwords and PIN Numbers

We’ve all been there—writing down passwords and PIN numbers on scraps of paper and tucking them away in our wallets for easy access. While this might seem convenient, it’s a huge security risk. If your wallet is lost or stolen, all your sensitive information could be compromised.

Instead of storing your passwords and PINs in your wallet, consider using a secure password manager. These apps encrypt your information and allow you to access it from your phone or computer. Many password managers even offer two-factor authentication for added security. By switching to a digital solution, you’ll keep your passwords safe without the need for physical notes that could be easily stolen.

3. Too Many Credit Cards

Carrying multiple credit cards may seem convenient, but it can quickly become overwhelming and risky. The more credit cards you carry, the more you expose yourself to potential theft or loss. Plus, it’s easy to forget which card is for what, leading to confusion when you need to make a purchase.

The solution is simple: only carry the credit cards you use regularly. Leave the rest at home in a safe place. If you find it difficult to decide which cards to carry, think about which ones offer the best rewards or benefits for your day-to-day purchases. You can also consider using a digital wallet on your phone to store your credit card information securely. This way, you can keep everything in one place without the need for a bulky wallet.

4. Expired Identification Cards

Expired IDs are another thing you should never carry in your wallet. While it might not seem like a big deal, carrying an expired driver’s license or ID can cause problems if you’re ever asked to show identification. It’s also a waste of space. Having an expired ID in your wallet only increases the chances that someone might mistakenly think it’s valid, leading to potential confusion or fraud.

Make it a habit to check the expiration dates on your IDs regularly. If one is about to expire, take the time to renew it before it becomes an issue. When you do carry identification, make sure it’s the most up-to-date version. Leave any expired cards at home, where they can be stored safely until you’re ready to renew them.

5. Unused Membership Cards

How many membership cards do you carry around that you never actually use? From gym memberships to store loyalty cards, it’s easy to accumulate a stack of cards that just take up space in your wallet. While it’s nice to have these cards on hand for discounts or rewards, carrying them around every day is unnecessary.

Instead of keeping every membership card in your wallet, take a moment to evaluate which ones you actually use regularly. If you rarely visit a particular gym or store, leave the card at home. Many stores now offer digital versions of their loyalty cards, which you can store on your phone. By going digital, you’ll have easy access to your membership information without the added bulk in your wallet.

6. Receipts You Don’t Need

Receipts are one of the most common culprits when it comes to wallet clutter. Whether it’s from a coffee shop, a grocery store, or a department store, we tend to hang on to receipts just in case we need them for returns or warranty purposes. However, carrying receipts you don’t need can weigh down your wallet and make it harder to find the important ones.

To keep your wallet organized, make it a habit to clean out old receipts regularly. If you’re unsure whether you’ll need a receipt in the future, consider scanning it with your phone and storing it digitally. There are apps that allow you to store receipts for tax purposes or future reference, eliminating the need to carry paper receipts. This simple step will keep your wallet lighter and more organized.

7. Important Documents You Don’t Need Every Day

There are certain documents that are essential but should never be carried around daily. Items like your passport, medical records, or insurance cards are important, but they don’t belong in your wallet unless absolutely necessary. Carrying these documents around can lead to unnecessary stress if your wallet is lost or stolen.

Instead, keep these important documents in a safe place at home. For example, if you’re traveling, only carry your passport when you need it, and store it in a secure travel pouch. If you need medical or insurance information, consider storing it digitally on your phone or using an app that keeps everything organized and accessible. By only carrying these documents when required, you reduce the risk of losing them and make your wallet more manageable.

8. Large Amounts of Cash

While it’s always a good idea to have some cash on hand, carrying large amounts of money in your wallet is risky. If your wallet is lost or stolen, you’ll be out of more than just your cards and IDs. Plus, carrying too much cash can make you a target for theft.

Instead of carrying large sums of cash, consider using a debit or credit card for most of your purchases. If you do need to carry cash, limit it to a reasonable amount for the day. You can also use mobile payment apps to make transactions without needing to carry physical cash. Keeping your wallet light and only carrying what you truly need will help protect your money and make your wallet easier to carry.

Final Thoughts

Your wallet should be a tool for convenience, not a source of stress. By eliminating unnecessary items like expired IDs, unused membership cards, and large amounts of cash, you can keep your wallet organized, secure, and free from clutter. Regularly check the contents of your wallet and remove anything you don’t need on a daily basis.

In today’s digital age, there are plenty of ways to store important information securely on your phone or in the cloud, so you don’t have to carry it around physically. By being mindful of what you carry in your wallet, you’ll not only reduce the risk of theft and loss but also make your daily life a little bit easier. Keep your wallet light, organized, and safe by leaving behind items that don’t belong.

Leave a Reply