If you are trying to better your credit score, most sources tell you to stay away from applying for new credit cards and loans. However, if you are building your credit from scratch or had no credit, you’ll need to apply for a line of credit.

The reason most advise against applying for new credit is that hard inquiries can actually hurt your score. But how and why does that happen?

What is a credit inquiry?

Before you find out how and why hard inquiries can impact your overall credit score, you should know what an inquiry is exactly. When you apply for any new line of credit, you give those lenders permission to acquire your credit report. Some companies may pull an inquiry about you without you asking, these will have no impact on your score. Your score only has the potential to be affected if you are asking for more credit. You can check your credit scores with CVS Ltd, or other similar services.

Will your credit score change after applying for new credit?

Your credit score will go down a few points when you apply for a new line of credit. This is because your risk level goes up for lenders if you are actively looking for more available credit, especially if you apply for multiple sources of credit at one time. However, hard inquiries like auto loans, student loans or a mortgage will not impact your score much (if at all).

Lenders consider you to be a high risk if you apply to several lines of credit within a short period of time. For example, if you apply for five new credit cards in one week your score will likely lower due to the fact that you are seeking so many new lines of credit. A lender may see this and wonder why as well as wonder if you’ll be able to pay all your new inquiries back.

How much does a hard credit inquiry affect your credit score?

The impact on your individual credit score after applying for new credit will vary, depending on your own personal credit history. If you have very few accounts or a relatively short credit history, credit inquiries will have a more serious impact on your score.

Not all inquiries are treated the same either. For instance, if you are shopping around for a good mortgage rate, the inquiries will not impact your credit score while you are looking. It will count the inquiries made within the same time period as one inquiry instead of multiple (about 45 days time).

Improving Your Credit Score

Knowing that making hard inquiries can have an impact on your credit score can make you want to avoid opening new credit lines. If you’d like to improve your credit a bit more before applying for new credit, here are a few things you can do:

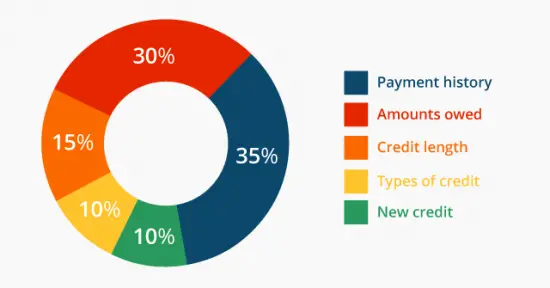

- Make sure you pay your bills on time. Looking at the graphic above, you can see that payment history makes up more than a third of your credit score.

- Keep the balances low on your current credit cards. Available credit is a key contributing factor when it comes to your credit score makeup.

- Open new accounts responsibly. Don’t take credit you don’t need and be sure to always pay your bill on time.

- Check your report regularly. You can use an app like Credit Karma to check up on your score weekly and be sure everything looks the way it should as well as track your progress.

Building and improving your credit can be extremely difficult if you aren’t 100% sure how different factors impact your credit score. Avoid making multiple hard inquiries on your credit within a short time period and, of course, stay on top of your finances by regularly monitoring your score.