College is insanely expensive, we all know that. It might seem easy to just take out some student loans to pay for your tuition because you can just pay it all back later, right?

While this is true, it is extremely important to make sure that you can afford to pay back those student loans monthly.

There are so many instances where students take out student loans to cover their entire tuition and aren’t able to handle the minimum monthly payments needed to pay back all of that debt. So, how do you know how much student debt is too much?

Student Debt Statistics

According to the U.S. Federal Reserve, more people have student loan debt than credit card debt. There are 45 million student loan borrowers in the United States who owe more than $1.56 trillion in student debt. This total is around $521 billion more than the total United States credit card debt.

The average monthly loan payment is $393 and the median is $222. If you graduate into a job that doesn’t pay very much, you could have a hard time paying this amount every month without it causing issues with your other financial responsibilities.

Over-Borrowing

It is super easy to take on more student loan debt than you can handle and it could have some serious negative consequences. Firstly, the more money you borrow, the more money you will have to pay back. This could easily cause a strain on your future financial situation.

Another negative consequence of borrowing too much money for student loans is that it can set back some other major goals and milestones.

For example, it can take you longer to buy a house, get married, or even retire in some situations. Being forced to pay back enormous amounts of student debt can prevent you from building the savings you need.

It is extremely important to make sure you aren’t borrowing too much and putting yourself into too much debt. To avoid over-borrowing, you should do some serious research on what your payments will look like for each loan you take.

Monthly Payments

The monthly payment you will be required to pay each month is dependent on the amount you borrow and the interest rate of your loan. It could be helpful to find an online student debt calculator to play with so you can have a better idea of how much money you will be paying back… Try out this loan simulator for a real estimate.

You also need to consider what your income potential is in the future. If you are trying to get into a field that pays well but is highly competitive, you might not be able to afford a high amount of student loans. This is also important to consider if you are wanting to enter a job field that doesn’t pay very high.

Let’s say you take out $25,000 in student loans. This amount would be easily manageable when earning a salary of $30,000 to $40,000 each year. Over 20 years, the monthly payments would be about $150. This is around the same amount you would pay for a used car.

However, if you take out double that amount at $50,000 you would have to take out federal and private loans to pay for your education. This is because private loans are necessary above $31,000. The monthly payment would be closer to $450 per month, which would be tight for someone making $40,000 to $50,000 each year.

What You Will Get

Another super important thing to consider is what the loans will help you with. Will the loans cover your books as well? What about dorms and parking? These are super important things to think about when you are deciding how much debt to borrow.

It is also important to consider the cost of the school you are going to. Say you get accepted to two different colleges.

They both offer similar learning and education quality, but one of the schools would require you to take out an additional $15,000 in loans. When you think about it, it would not make sense to go to the more expensive school and take the extra debt.

Rules to Follow

When you are looking at all of the statistics of student loans, it can be overwhelming. Here are a few simple tips to make the process easier and less stressful for you.

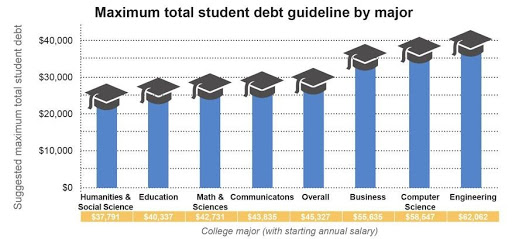

- First, do your research. Look at the salary of the career you want to enter. Check out the career growth patterns to make sure there are continuously opening positions in that field. Take a look at the repayment amount you will have and determine what the monthly payments might be.

- Next, check out some cheaper alternatives if necessary. You could start at a community college to save some money. Public universities are also cheaper than private ones, so if you are looking at private universities you should consider checking out some public ones, too. There is also the option to work while you are in school and pay as you go along.

- It is a good idea to never borrow more than the salary you will most likely be making your first year after graduation. This will help ensure that you can afford the monthly payments. You should also consider your current debt-to-income ratio and what it will look like in the future with your loans.

- Only borrow exactly what you need for educational expenses. This includes tuition, books, and dorms if necessary. If you keep these rules in mind, you should be able to easily keep your student debt manageable.

Things to Consider as a Parent

If you are a parent, it is easy to become eager to help your child achieve their dream of going to their favorite college. There is a loan option for parents to take out called the Parent PLUS loan. These are federal student loans for parents to take out to pay for education expenses that are not typically covered by financial aid.

However, it is important to think about your financial future before taking out loans to help pay for college.

Consider your annual salary and current budget. Can you afford to fit in another monthly payment? Taking out large amounts of student loans can push out your retirement date.

If you do realize that you’ve taken out too much debt to pay for college, you might be able to adjust your monthly payments by changing your repayment plan.

Instead of the regular 10-year repayment plan, you might be able to switch to an extended repayment or income-contingent repayment. This could create enough room in your budget and avoid affecting your retirement savings.

How Much Debt is Too Much?

There is no specific point of “too much”, but it will depend on the ability you have to pay the loans back after you’ve finished school. You could take out $10,000 in loans but not be able to manage those payments, and in this case, that student loan debt would be too much for you.

In another scenario, you could graduate school with $75,000 in debt and immediately get a high-paying job to cover those monthly loan payments. In this case, even $75,000 isn’t too much. It is important to consider all things when determining how much you should take out in loans.

It is easy to take out too much student debt because you don’t have to focus on paying it back right away, but it will still be there in the future. You want to make sure you have a manageable amount of debt so you can still pay it back even if you don’t get into the career you were hoping for.

Leave a Reply