“What gets measured, gets improved.”

If you haven’t seen my debt freedom progress reports before, each month I bring you a recap of the previous month’s progress on paying off our debt.

This serves two purposes — to keep my husband Mike and me accountable to our financial goals and to give you a look behind the scenes of our strategy for paying off our debt.

My hope is that giving you this open and honest review will inspire you to keep going on your own debt free journey. Or if you haven’t started yet, I am hoping this information will help fuel your fire to get going on reaching your financial goals.

Don’t worry, I don’t go line by line through our budget. Instead, I give a rundown of things that happened during the month that affected our budget and point out some areas that worked and some that need improvement.

While we have already paid off a lot of debt in a short amount of time, you will find that our journey is not perfect in any way. When Mike and I review each month, we often discover opportunities we missed where we could have put more money toward our debt.

We definitely make mistakes, and many times we will find situations where we have spent more money than necessary.

But we don’t let these findings discourage us. We try to learn from our mistakes and use them to propel us forward into the next month.

Let’s take a look at how September went…

Our Financial Goals for September 2015

If you’ve been following our journey, then you know that our ultimate financial goal is to pay off all of our debt, including our mortgage, by the time we turn 40 — less than six years away.

In order to stay on track, we set our main financial goals for 2015 in our January 2015 Debt Freedom Progress Report as follows:

- To pay off the remaining balance of our home equity line of credit (HELOC) by June 1, 2015. (The balance as of January 1st was $21,469.33.)

- And, to pump up our emergency fund to $25,000.00 by December 31, 2015. (We were keeping it at $5,000.00 until our HELOC is paid off.)

We didn’t meet our first goal of paying off the HELOC by June 1st, but we did meet both goals in August by selling our 6-bedroom house and downsizing to what we call our dream house!

You can read more about that process here.

We have some remodeling to do in our new house. It currently has three bedrooms, but we really need three bedrooms AND an office.

Luckily, our new house has an unfinished basement with plenty of space to add an office and a bathroom!

We thought that project would be complete before the end of the year, but our contractor now says that will have to wait until January.

Until then, we decided to paint the interior of our house and install a central vacuum system. That was our project for the month of September.

Until the remodel is complete, we’re going to pay the minimum payment on our mortgage and save the extra that we would normally put towards our debt just in case the remodel ends up costing us more than we originally planned. (I know, that rarely happens.)

Since we’ve been going over on our food budgets all summer due to the move, we planned to get back on track with those for September.

With that in mind, we decided our goals for September would be:

- Stick to a $400 budget for groceries,

- A $100 budget for restaurants, and

- Paint the interior of the house and install a central vacuum system, like we had at our old house!

What Went Well

We upgraded our house!

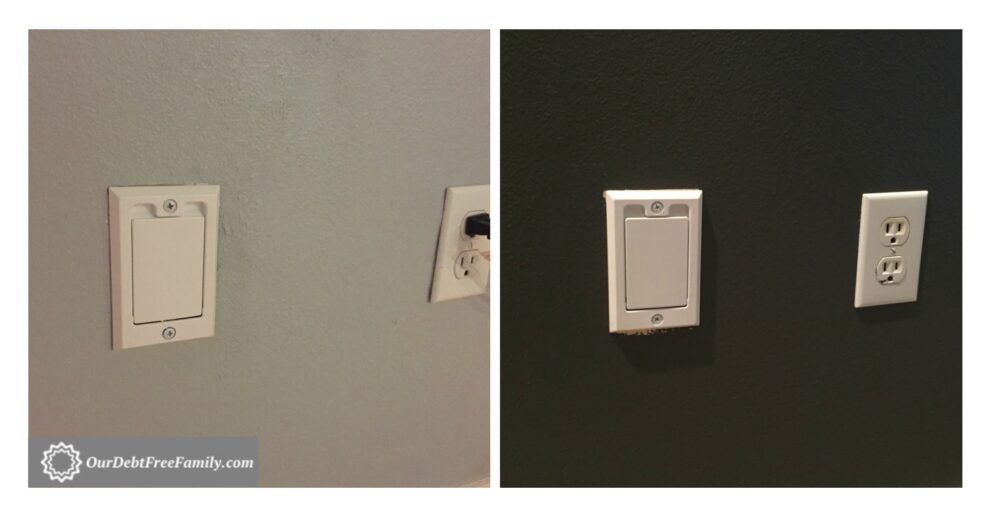

Once we got settled after our move into our new house in August, my husband Mike got to work on installing our central vacuum system.

It was an expensive process, but we had a central vacuum system in our old house and really loved the convenience it provided.

Having two kids, two cats, and a dog, we have a lot of messes to clean up. Plus, we really appreciate that our house does not smell like stinky dog (if you’re a dog owner, you know what that is) while vacuuming because the canister is stored in the garage.

When we were house shopping, we were looking for a home with a central vacuum system already installed, but those homes had a much higher price tag. Since we knew we would be making a sizable profit from the sale, we decided that Mike would install the central vacuum system into our new home.

He bought some new power tools for home projects and enjoyed finding things that needed to be fixed and drilled.

He quickly installed the central vacuum system before the painters came to paint our walls, and I have to say I’m impressed with how professional it looks! It looks like the system came with the house!

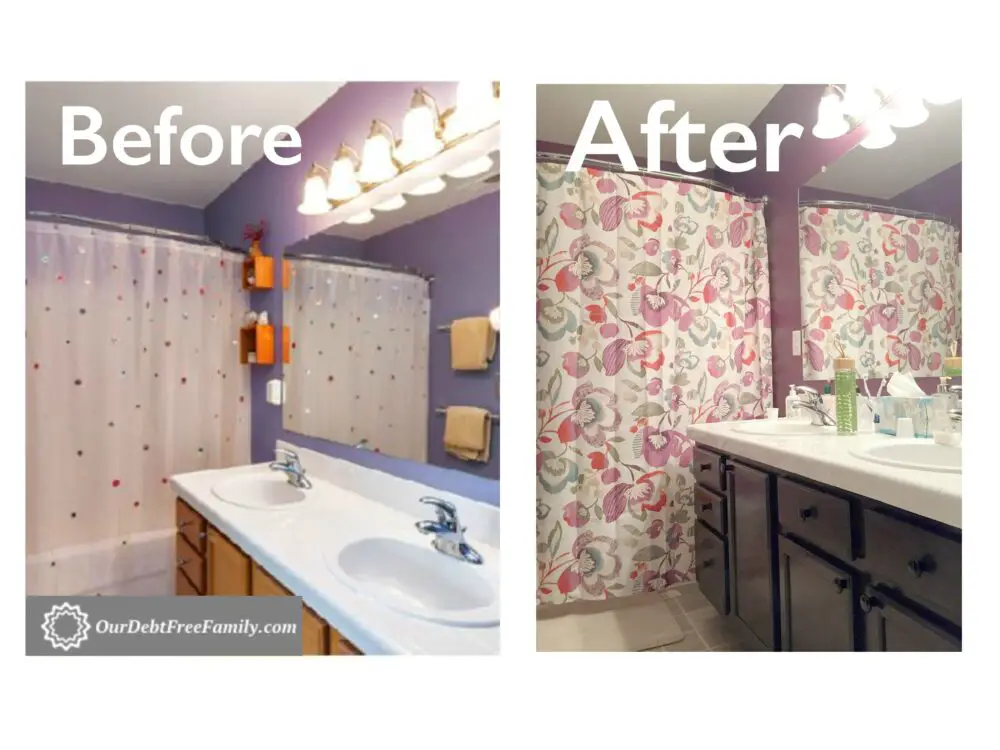

The painters came in early September to paint our walls.

We considered painting the walls ourselves, but that would probably mean that Mike would end up being the one to paint, and it would take him several weeks after work and on weekends to get it all done.

The painters got the walls painted in less than a week, and since they used high quality materials, it only cost us a few hundred dollars more than it would have cost us to do it ourselves.

The saved time and convenience of letting the painters come and get it done quickly was worth the extra cost.

When they were here, we decided to have them paint our cabinets too. We preferred the dark wood color that goes with our furniture instead of the natural light wood color of the oak.

Jeff, co-owner of Herinck Painting & Decorating, said that the cabinets were in great condition so they didn’t need to be replaced, which would cost thousands more.

He and his team painted the cabinets in the kitchen and our two bathrooms, and now it looks like a brand new house! Jeff estimates that we increased the value of our home by $15,000-$20,000!

If you’re in Oregon or SW Washington and need some painting done, I highly recommend Jeff and his crew! They were quick, professional, and performed quality work. They were also the team who re-caulked and painted the outside of our old house.

The cost of the parts for the central vacuum system was $1,221.93, and the total cost for the painting was $3,850.

There are other upgrades that we want to make to the house like installing new blinds and doing some landscaping in our backyard, but those projects can wait.

But we are getting closer to this truly being our dream house!

We brought in $4,358.12 in extra income!

In spite of the costs of the upgrades, we had some pleasant surprises!

Mike brought home $458.44 in overtime during September so his paychecks were larger than expected. (We like it when that happens!)

We received a check in the mail for $3,732.93 which was a welcome surprise! It was a refund check for our escrow account on our old mortgage! (Don’t you just love a surprise $3,700 check?)

We weren’t expecting that!

And the title company must have overpaid our home equity line of credit during the sale process because the bank refunded us $56.75!

Plus, Mike got a little older and turned 35 so he also got some birthday money.

All in all, it was a good month income-wise!

What Didn’t Go Well

We went way over on our food budgets

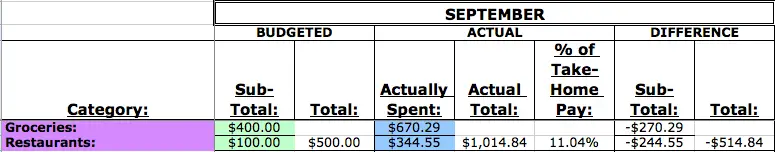

Since we only spent $407.01 on groceries in August, we planned to spend only $400 on groceries in September.

And we expected we would eat out a little during the month of September since the painters would be here and the kids and I would need to be out of the house for the priming. Plus, Mike and I celebrated our sixth wedding anniversary, and we celebrated his birthday in September.

We knew it would be a busy month!

But after the month of August, when we put $40,000 into savings and paid off $31,000 of debt, we were still feeling, um, rich during the month of September.

So instead of sticking to our plan of $400 for groceries and $100 for restaurants, we blew them both out of the water.

Here’s how our grocery and restaurant budgets looked for the month of September:

I’m ashamed to admit that we spent more than double our budget on food during the month of September!

But I promised to let you know what we do right with our monthly budget and when we get off track, and in September we got way off track with our food budgets.

Part of the grocery expense was due to the fact that I’m working with my friend, Daniele Della Valle, a nutritional therapy practitioner (I call her a nutrition coach to make it easy), to lose the weight I put on during the house selling/buying/moving process. She provided a list of foods and supplements that I should be consuming daily, and let me tell you, they’re not cheap.

Mike and I decided that me sticking to the plan and blowing our grocery budget would be worth it, and in the first two weeks on my new diet, I lost 9 pounds! Woo!

Anticipating that I would be feeling restricted once I started the plan, we went out to eat more than usual, which caused us to blow our restaurant budget too! 🙁

Not wanting to make Mike feel like he got the short end of the stick (or our restaurant budget) because his birthday was on the 30th of the month, we went out to eat for breakfast and dinner.

We’re definitely planning to be better in October!

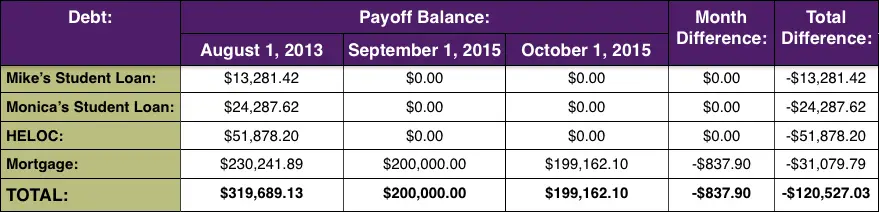

Our total debt balance didn’t change

I always report our debt balances on the first of every month so you’ll notice that the debt balance did decrease on October 1, but technically the balance did not change during the month of September.

This is actually not a bad thing since our first mortgage payment on our new loan wasn’t due until October 1st.

Now that our only debt is our mortgage and we don’t plan on paying extra to it until our remodel is complete, we don’t expect our debt balance to decrease dramatically over the next few months. And we’re okay with that.

As I mentioned earlier, our goal is to save the extra amounts that we would have put toward debt for the remodel just in case it costs more to complete than we expect.

Here’s how our Debt Snowball changed from September 1 to October 1 and since we started our plan in August 2013:

As of October 1st, we paid off $120,527.03 of debt!

In just over two years, we paid off $37,569.04 in student loans, $51,878.20 in a home equity line of credit, and $31,079.79 of our mortgage!

In the month of September, we reduced our total debt by 0.42%. Since we started our plan back in August 2013, however, we have reduced our non-mortgage debt by 100% and our total debt by 37.7%!

We are ahead of schedule to meet our long-term goal of paying off all of our debt, including our mortgage, by the time we turn 40. If we continue to reduce our debt at this rate (37.7% reduction in 26 months), we will pay off our debt by May 2019 when Mike is 38 and I am 37!

Goals for October (and some exciting news!)

We don’t have any major home projects going on in October, and I’m continuing with my new diet so we decided to up our grocery budget slightly to be more realistic. But we’ve also decided to lower our restaurant budget.

AND, I’ve got some exciting news!

At the end of the month, I will be officially launching my financial coaching program, the Debt Freedom Roadmap!

This has been a long time in the making.

I’ve had the honor of coaching some of our friends for the past 18 months, and I’m now ready to broaden my scope and help more people.

I’ve developed a 6-step system to help you take control of your money so you can pay off debt and work toward true financial freedom, and I couldn’t be more excited to share it with you!

Click here if you’d like to be notified when the Debt Freedom Roadmap is available.

With all of this in mind, we decided our goals for October would be:

- Stick to a $500 budget for groceries,

- A $50 budget for restaurants, and

- Officially launch my financial coaching program!

Final Thoughts

We had a disappointing month regarding our food budgets, but did well on the income side of the budget.

We’re definitely motivated to stay on track for October, and I can’t wait to share with you how we do.

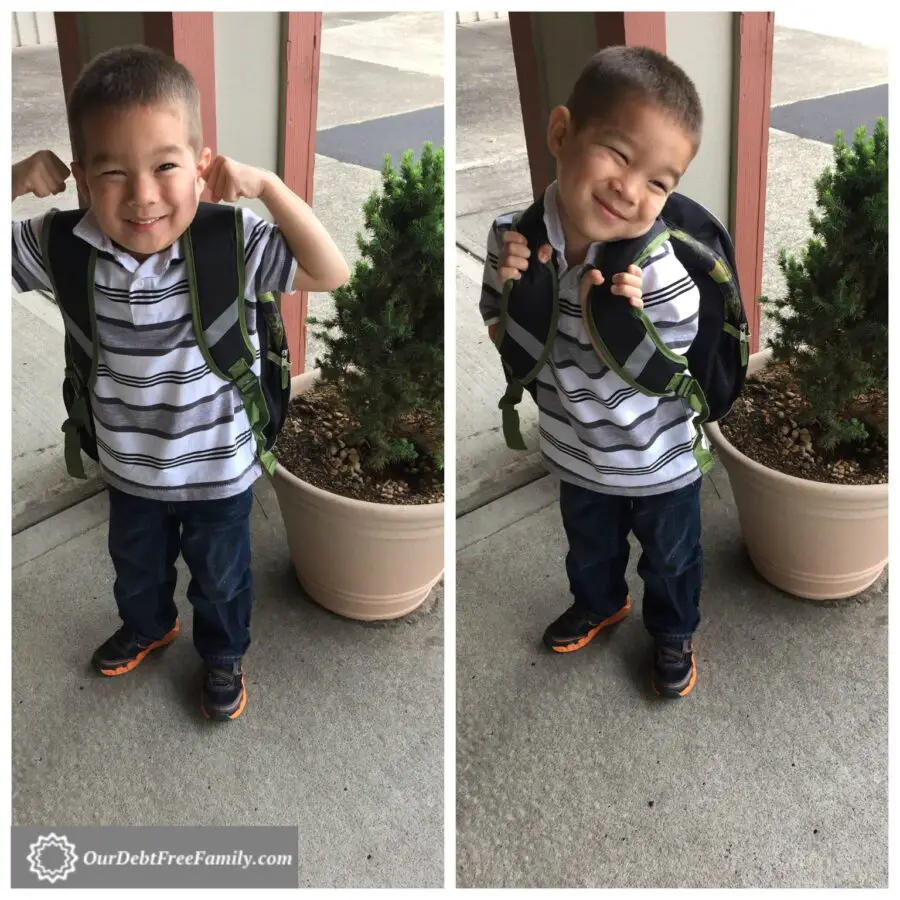

We’re much more settled in our new home and back to a normal schedule now that Jayden is in school.

Here he is on his first day of school this year in the Pre-Kindergarten class:

Now, we’re getting ready for Halloween, and the holidays will be here before we know it.

We feel great knowing that we’ve already met our financial goals for the year, but if you haven’t met yours yet, it’s not too late! There are still two and a half months, and great strides can be made with diligence and focus.

Keep moving forward, focus on your end goal, and make progress each month!

Now I’d love to hear about you!

How did you do on your September goals? What are your goals for October? Share in the comments below.

Great read! I am inspired to cut down our $1300 grocery bill. You were very transparent- I love that! Congrats on the new house :).

Thanks, Nichole! Glad you liked the post! 🙂 Keep me posted on your grocery bill!

Your attention to financial details and commitment to measuring and reporting is inspiring, Monica. Way to go!

Aw, thanks so much, Sarah!

So many great tips!

Thanks, Chloe!

Outstanding savings on the central vacuum! I had no idea it could be done for just that amount – not cheap but so worth the convenience for cleaning and since cleaning already isn’t fun anything to help save time and encourage cleaning by making it easier is worth an investment!

Oh, thanks! I didn’t realize we got a good deal on the central vacuum system. I knew we’d save money by having Mike install it himself, but it was still a lot of money. It’s worth it to us, though! 🙂

Yes, having two kids and a dog and just busy, messy lives in general, we LOVE having a central vac! Such a worthwhile investment, and so great that you two have already begun to make your new house a home! And, what an AWESOME $3K+ surprise check! Hooray for unexpected money!

Thanks, Marlynn! We’re loving our new home and excited for the upcoming addition too! Surprise money is always welcome! 🙂