“What gets measured, gets improved.”

If you haven’t seen my debt freedom progress reports before, each month I bring you a recap of the previous month’s progress on paying off our debt.

This serves two purposes — to keep my husband Mike and me accountable to our financial goals and to give you a look behind the scenes of our strategy for paying off our debt.

My hope is that giving you this open and honest review will inspire you to keep going on your own debt free journey. Or if you haven’t started yet, I am hoping this information will help fuel your fire to get going on reaching your financial goals.

Don’t worry, I don’t go line by line through our budget. Instead, I give a rundown of things that happened during the month that affected our budget and point out some areas that worked and some that need improvement.

While we have already paid off a lot of debt in a short amount of time, you will find that our journey is not perfect in any way. When Mike and I review each month, we often discover opportunities we missed where we could have put more money toward our debt.

We definitely make mistakes, and many times we will find situations where we have spent more money than necessary.

But we don’t let these findings discourage us. We try to learn from our mistakes and use them to propel us forward into the next month.

Let’s take a look at how October went…

Our Financial Goals for October 2015

If you’ve been reading the blog for a while, then you know that our ultimate financial goal is to pay off all of our debt, including our mortgage, by the time we turn 40 — in about six years.

Now that we’ve paid off all of our non-mortgage debt, boosted our savings, and only have our mortgage left, we’ve pressed pause on paying off our debt.

But don’t worry. This is only temporary since we will be renovating our unfinished basement and installing an office and bathroom in the coming months.

Once the remodel is complete, we’ll get back to paying our mortgage off as quickly as possible.

Since sticking with our food budgets has been a constant struggle for us, we decided to include those as part of our goals for October.

And in October, after many months of working with some of our friends to help them create a plan to get out of debt, I planned to officially launch my financial coaching program, the Debt Freedom Roadmap!

With all of this in mind, our goals for the month of October were:

- Stick to a $500 budget for groceries,

- A $50 budget for restaurants, and

- Officially launch my financial coaching program!

What Went Well

We stuck to our food budgets!

We surprised ourselves and came in way under budget for both groceries and restaurants!

This is huge since we’ve had so much trouble with consistently sticking to our food budgets!

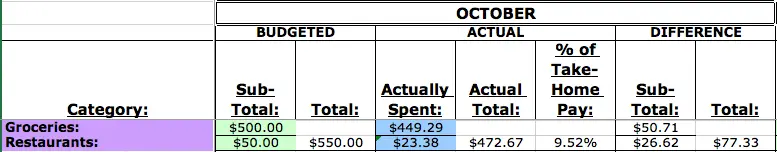

Here’s how our grocery and restaurant budgets looked for the month of October:

As far as groceries were concerned, we didn’t even have to watch every penny. We only bought what we truly needed so we easily came in under budget.

For restaurants, I didn’t eat out (aside from my trip, see below) since I’ve been sticking to a new diet to lose the weight I put on during our move. Mike ate out a few times with the kids, and I bought the kids food when we went to the zoo, but we kept each meal cheap.

Avoiding going out as a family definitely helped to keep us on track.

It feels good to know that when we focus on just the essentials, we can stick to a reasonable budget for our family of four!

We received $1,416.02 in refunds!

We switched insurance companies:

With our recent move, our mortgage broker recommended a new insurance agent to us. We thought it would be a good time to compare rates for our home and auto insurance so we gave him a call to see what he could do for us.

Turns out the rates were much lower with his company so we decided to switch both our home and our auto policies to him. Both companies are rated highly and have great reputations, but for us, the lower premiums was reason to switch.

We paid $630 for home and auto premiums in August to our new insurance company, but received two checks from our old insurance company in October that totaled $1,085.82!

Not a bad deal!

We were overcharged for Internet:

Also, when we moved in August, we decided to switch Internet providers since we had more options that serve our new neighborhood. When I called back then to find out the new company’s rates and schedule the set-up, the numbers the gentleman gave me were drastically different than the numbers we saw on our monthly bill.

We understood the first bill would be higher due to the installation and activation fees, but the second bill we received in October still looked higher than we expected.

I made a call to find out what was going on and what all the charges represented to make sure they were necessary.

After talking with two people, I was able to get a credit for $130!

We were being overcharged, and the gentleman I spoke with kindly reversed the excess charges and changed our rates going forward!

We overpaid for dental work:

And last but not least, we received a refund from our dental clinic for $200.20!

It turns out that back in 2013 when I had some dental work done, the insurance company paid more than expected so I had overpaid my out-of-pocket portion.

When I recently saw my dentist, he told me about the credit sitting on my account and told me to call back to request a refund after the insurance company submitted payment for my last appointment.

A quick phone call put $200.20 back into our bank account!

Here’s the lesson —

- double-check your statements,

- shop around to see if there’s a better deal available, and

- take the time to make the phone call that could put hundreds of dollars back in your pocket.

What Didn’t Go Well

I did not launch my coaching program

After working with friends for the past 18 months to help them create a plan to get out of debt, I was finally ready to help more people do the same.

I decided that October would be the month for me to open up my financial coaching services to anyone — once we were settled in our new house and before the rush of the holidays.

Unfortunately, due to technical difficulties, I had to push back the launch of my financial coaching program, the Debt Freedom Roadmap, to the first week in November.

It actually worked out better, though, because I had a few more days to prepare for my free online training and get all of the pieces in place.

I’ll share more next month in my November update. 🙂

A lot of business expenses

On October 1st, I flew to San Diego for a once-in-a-lifetime trip to attend a business-building workshop put on by my online mentor, Amy Porterfield.

My goal with this website is to be a resource to help you make smart money choices so you can pay off debt and work toward true financial freedom.

But it takes a lot of time to build this website, and Mike and I have both invested a lot of time and money toward this venture.

A lot of websites try to recoup their costs by placing ads on their site, but I would rather not clutter up my site with ads and distract you from what you’re here for. I would rather give you an ad-free experience and find other ways to recoup the costs.

In an effort to go from blog to business, earlier this year I invested in Marie Forleo’s B-School and signed up through Amy Porterfield. By doing so, she provided a whole array of bonuses, including behind the scenes into her multi-million dollar business, multiple online trainings, a private Facebook group where she answered our questions, and a live workshop in San Diego.

Back in February when I signed up, Mike and I agreed that I would attend the workshop to take full advantage of Amy’s bonuses. Even though the workshop was free to those who signed up for B-School through Amy, we still had to cover my airfare, meals, and hotel costs.

Since we had put $40,000 into savings in August, we had the money, and off I went to San Diego.

It was an incredible experience, and not only did I get to meet Amy and discuss my business with her, I also met a lot of incredible people — many of whom I’ve stayed in touch with since the event.

For this girl, it was a dream come true!

But the trip was not cheap. We had booked my flight earlier in the year, but we still had to pay for the hotel, my baggage fees, and my meals.

Luckily, I was able to share a room with two other women so for three nights, I only spent $281.88 on the hotel.

I was able to stick to my diet while I was there, but the food was not cheap. I spent $128.93 on food for the trip.

I spent $11.96 on an Uber from the airport to the hotel when I arrived. (I was fortunate to catch a ride to the airport with two other ladies who covered my cost.)

And I spent $50 on baggage fees — $25 on the flight there and $25 on the flight back.

If that weren’t enough to pay for during the month of October, when I returned, Mike and I made the decision to get a new iMac computer.

We had both been using our laptops, but Mike’s laptop is on the fritz since it’s about 75 years old in computer years (he bought it in 2008) and mine has storage issues since it’s a tiny Macbook Air.

We had intended to wait to purchase the iMac, but when his laptop kept freezing one night when he was trying to help me with graphics for my launch, we decided it was time.

And remember my technical difficulties I mentioned earlier?

I had bought a platform for conducting online trainings, which cost $430.35. Not cheap, but in comparison, there’s a platform that is $400 per month so this was a much cheaper option.

While that was a lot of money for the month, all of the expenses were expected. They just happened to occur all at once, but November should be much less expensive in this area!

Slow debt freedom progress

Now that our only debt is our mortgage and we don’t plan on paying extra to it until our remodel is complete, we don’t expect our debt balance to decrease dramatically over the next few months.

And we’re okay with that.

Our goal right now is to save the extra amounts that we would have put toward debt for the remodel just in case it costs more to complete than we expect.

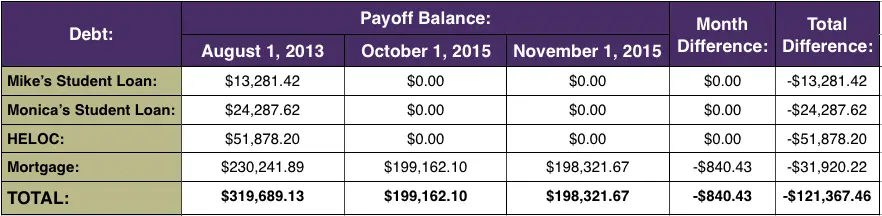

Here’s how our Debt Snowball changed from October 1 to November 1 and since we started our plan in August 2013:

As of November 1st, we paid off $121,367.46 of debt!

In just over two years, we paid off $37,569.04 in student loans, $51,878.20 in a home equity line of credit, and $31,920.22 of our mortgage!

In the month of October, we reduced our total debt by 0.42%. Since we started our plan back in August 2013, however, we have reduced our non-mortgage debt by 100% and our total debt by 38%!

We are ahead of schedule to meet our long-term goal of paying off all of our debt, including our mortgage, by the time we turn 40. If we continue to reduce our debt at this rate (38% reduction in 27 months), we will pay off our debt by August 2019 when Mike and I are both 38!

Goals for November

We’re really encouraged that we were able to stay under our food budgets for the month of October and still have room to spare.

But with family coming to town for Thanksgiving, we’re expecting that we’ll be eating out a bit more than usual.

And in November, I did finally launch my financial coaching program, the Debt Freedom Roadmap!

With this in mind, we decided our goals for November would be:

- Stick to a $500 budget for groceries,

- A $100 budget for restaurants, and

- Officially launch my financial coaching program!

Final Thoughts

October was a great month for us financially, even though we had larger expenses than usual.

Luckily, we were able to offset some of the costs with the refunds we received.

Going into the holiday season, we know we’ll be spending more than most months on gifts and experiences.

But we’ve saved up for gift giving throughout the year using our Gifts Budget.

It’s a magical time of year, especially for kids! And we plan to enjoy this time with our friends and family.

Now I’d love to hear about you!

How did you do on your October goals? What are your goals for September? Share in the comments below.

The conference sounds awesome, Monica! And great job sticking to your food and restaurant budgets!! Great work!

Thank you so much, Laurie! Really appreciate your constant encouragement and support. 🙂 Have a happy Thanksgiving!

Wow. Now I know where to look for budgeting inspiration! Reminds me to look into my own Internet and cable. Also, so cool you got to attend that conference and talk with Amy!

Thanks, Brianne! Yes, in the world of paperless statements, it’s easy to assume that everything is correct, but we should check just in case. You won’t know if you’ve been overcharged unless you do!

So glad you got to take your trip of a lifetime and meet Amy! Sounds exciting!

Thanks, Laura! It was! I was beaming for days! 🙂 She doesn’t go to a lot of events so I don’t know when I’ll get the chance to meet her again. I had to jump at the chance when I had it!

Wow – you still saved a lot on that business trip to San Diego! You could have spent MUCH more! 🙂 It’s always nice to get money back, and I think it’s important that people actively pursue that money instead of leaving it on the table. Your work getting money back from being overcharged for internet and getting your dental refund is a good reminder!

I guess that’s true. We’ve been so concerned with not spending money unnecessarily that it felt like a huge splurge, but I did well on keeping costs low. Thanks for pointing that out, Marlynn!