I know, I know.

This is a little late since we’re almost into October, but I wanted to catch you up on our numbers for the summer.

So this week I’m bringing you a quick recap of our numbers for June and July, and next week, I’ll catch you up on how much debt we paid off in August when we downsized and moved into our dream house!

If you haven’t seen my debt freedom progress reports before, each month I bring you a recap of the previous month’s progress on paying off our debt.

This serves two purposes — to keep my husband Mike and me accountable to our financial goals and to give you a look behind the scenes of our strategy for paying off our debt.

My hope is that giving you this open and honest review will inspire you to keep going on your own debt free journey. Or if you haven’t started yet, I am hoping this information will help fuel your fire to get going on reaching your financial goals.

Don’t worry, I don’t go line by line through our budget. Instead, I give a rundown of things that happened during the month that affected our budget and point out some areas that worked and some that need improvement.

While we have already paid off a lot of debt in a short amount of time, you will find that our journey is not perfect in any way. When Mike and I review each month, we often discover opportunities we missed where we could have put more money toward our debt.

We definitely make mistakes, and in retrospect, many times we will find situations where we have spent more money than necessary.

But we don’t let these findings discourage us. Instead, we try to learn from our mistakes and use them to propel us forward into the next month.

Here’s how we did in June and July 2015.

Let’s take a look at June first!

Our Financial Goals for June 2015

If you’ve been following along on our journey, then you know that our ultimate financial goal is to pay off all of our debt, including our mortgage, by the time we turn 40 — in about six years.

In order to stay on track, we stated our main financial goals for 2015 in our January 2015 Debt Freedom Progress Report as follows:

- To pay off the remaining balance of our home equity line of credit (HELOC) by June 1, 2015. (The balance as of January 1st was $21,469.33.)

- And, to pump up our emergency fund to $25,000.00 by December 31, 2015. (We were keeping it at $5,000.00 until our HELOC is paid off.)

Unfortunately, as I shared in our May 2015 Debt Freedom Progress Report, we didn’t meet our first goal of paying off the HELOC by June 1st, but we did make a huge decision that would help us meet both goals in a matter of months.

As if life weren’t hectic enough with two kids under 4, two cats, and a dog, it got a little more crazy!

And we’ve were focused on selling things to bring in extra income and reduce the amount of stuff we needed to move.

We’d also been working on sticking to our grocery and restaurant budgets. But we decided to increase our restaurant budget for the month since we knew we had some events planned in June, and we would appreciate the convenience of eating out more when we had to be out of the house for showings to prospective buyers.

With all of this in mind, our goals for the month of June were:

- Stick to $500 budget for groceries, aside from what we spend on our 1/4 cow from Basket Flat Ranch that we ordered in April,

- A $150 budget for restaurants, and

- Bring in extra income of $500.

Here’s how we did on our June goals

We stuck to our grocery budget!

For the month of June, we kept our grocery budget at $500, but we expected that we would need to pay the balance due for our quarter of a cow that we ordered from Basket Flat Ranch.

Because weights of cows vary (obviously ;)), we didn’t know how much to estimate for this cost. While this cost is included in our “actual” grocery budget, we kept our “budgeted” amount at $500. See below.

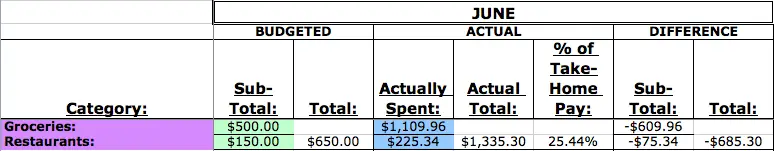

Here’s how our grocery and restaurant budgets looked for the month of June:

It looks like we went way over, but our balance due for the beef was $629.35 so we actually stayed within our $500 (non-cow) budget by $19.39!

We continued to follow the guidelines I laid out in my post about how we cut our grocery spending in half and ate out a bit more than we usually do, but in June, we found it easy to stay under budget.

This was our best month for our grocery budget since February!

But we went over our restaurant budget

You’ll see from the picture above that we exceeded our restaurant budget by $75.34. Yikes!

We had increased our budget from our usual amount of $50 to $150 to account for our trip up to Vancouver, B.C. and our expectations of eating out a little more for the convenience factor when we had house showings for our house.

Even with the increase, we still went over!

We kept it cheap for most of the month but went out to a nice breakfast for Father’s Day and a nice dinner. A few days later, we went out for dinner during a house showing.

If we would have cut two of these meals out and eaten at home, we would have stayed under budget.

We didn’t bring in $500 of extra income

Our plan to bring in $500 of extra income was to sell things we don’t need, use, or love so that we wouldn’t have to move them. Mike posted several items on Craigslist and OfferUp, but only a couple of items sold.

Those items and the interest earned in our checking account brought in $204.10 in extra income.

Mike did work a bunch of overtime though, so his paychecks for the month of June were $245.39 more than we expected.

So instead of bringing in $500 extra income, we brought in $449.49.

Even though we didn’t meet our goal, the extra did help when it came to the additional expenses for the move.

Slow debt freedom progress in June

As I stated in our May 2015 Debt Freedom Progress Report, our financial focus changed to selling our house and looking for a new one so we decided to put our plan to pay off the HELOC on hold.

We expected to have more expenses than usual over the summer due to some minor repairs that were needed on our house and costs associated with moving. With that in mind, we focused on saving as much money as possible to accommodate these additional costs.

We anticipated that once the sale of our house was final, we’d be able to pay off the HELOC and boost our emergency fund at the same time. This would more than make up for our need to “press pause” on our debt snowball for a couple of months.

So for the month of June, we only paid the minimum amounts due on our mortgage and HELOC.

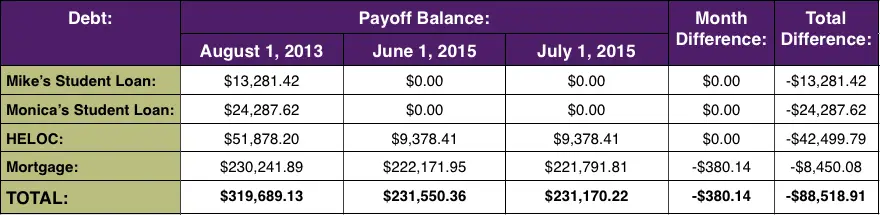

Here’s how our Debt Snowball changed from June 1 to July 1 and since we started our plan in August 2013:

As of July 1st, we had paid off more than $88,500 of debt!

In the month of June, our non-mortgage debt stayed the same, while our total debt was reduced by 0.16%. Since we started our plan back in August 2013, however, we have reduced our non-mortgage debt by 89.5% and our total debt by 27.7%!

Even though we didn’t make much progress in the month of June, we were still on track to meet our long-term goal of paying off all of our debt, including our mortgage, by the time we turn 40.

If we continue to reduce our debt at this rate (27.7% reduction in 23 months), we will pay off our debt by July 2020 when Mike is 39 and I am 38!

Goals for July

The best thing that happened during the month of June was that we found our dream house!

Now that we had that piece of the puzzle solved, we just needed a buyer for our house to move forward with the purchase.

So our goals for the the month of July were:

- Stick to $500 budget for groceries, aside from the processing fees for our 1/4 of a cow from Basket Flat Ranch,

- A $150 budget for restaurants, and

- Find a buyer for our house!

Here’s how we did on our July goals

We stuck to our grocery budget again!

Even though we paid the balance due for our beef in June, we still had to pay the processing fees to the butcher when we picked up our meat in July.

Again, we weren’t sure how much those would be until we went to pick up the meat so it was hard to budget.

But with the craziness that occurred in July with the sale of our house, we easily stuck to our grocery budget!

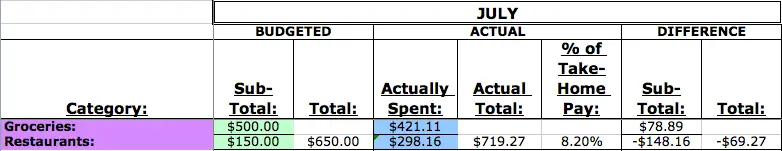

Here’s how our grocery and restaurant budgets looked for the month of July:

As you can see, even with the processing fees included, we spent only $421.11 on groceries!

The processing fees were $166.50 so that means we only spent $254.61 at the grocery stores for the entire month of July!

The processing fees were $166.50 so that means we only spent $254.61 at the grocery stores for the entire month of July!

Go us!

In total, we spent $1,045.85 for 204 pounds of grass-fed beef raised with organic practices and cut the way we requested. That breaks down to only $5.13 per pound!

But we went over our restaurant budget again

Once again, we increased our restaurant budget from our normal amount of $50 to $150, but it proved to not be enough.

We ate out quite a bit during the month of July and spent nearly double the amount we budgeted!

Some contributing factors were when we splurged on date night and my birthday.

Here we are celebrating my birthday on the Columbia River at Joe’s Crab Shack:

We found a buyer!

We allowed ourselves to celebrate and spend more on going out to eat when we finally found buyers!

Once we knew the transaction was moving forward and we would be reaching our goals quickly, we splurged and spent more than we should have even though we knew we had a bunch of expenses ahead due to the move.

To read more about the ups and downs of selling our house and finding our dream house, check out my recent post, Major Update On Our 2015 Financial Goals, Part 1.

Selling your house ain’t cheap, folks!

Selling your house and buying a new one sounds fine and dandy until you realize how expensive it can be!

I’m planning a post on the expenses you can expect when buying and/or selling a home that will go into greater detail.

For the month of July alone, we spent $7,155 on home repairs for our old house, plus $915 on the inspection and appraisal for our new house!

No typos, I swear!

In our major update, I share how there were some surprises that came up in the inspection.

Here’s the breakdown:

- $1,192.40 to replace the trim and some minor water heater repair,

- $162.60 to service the HVAC system,

- $5,800 to re-caulk the siding and paint the entire exterior of the house,

- $365 for the home inspection of our new house, and

- $550 for the appraisal for our new house.

Whew!

It could have been more, though. Our inspector gave us a discount since our real estate agent referred him to us. And the buyers of our old house agreed to cover half of the costs of the re-caulking and painting, but to keep things simple, we just reduced the amount we would pay of their closing costs by $2,900 so we still had to come up with the full payment up front.

And we still had to get the floors refinished and move in August!

Since we only had $5,000 in our emergency fund, we withdrew what we had invested in a brokerage account. The amount was $6,530.30, and it definitely saved us from having to go into debt to cover all of the expenses.

Minimal debt freedom progress in July

Once again for the month of July, we only paid the minimum amounts due on our mortgage and HELOC.

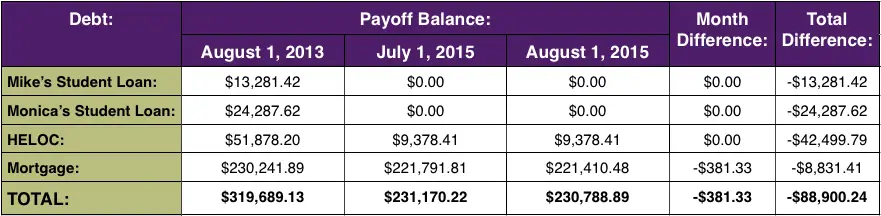

Here’s how our Debt Snowball changed from July 1 to August 1 and since we started our plan in August 2013:

As of August 1st, we had paid off almost $89,000 of debt!

In the month of July, our non-mortgage debt stayed the same, while our total debt was reduced by 0.16%. Since we started our plan back in August 2013, however, we have reduced our non-mortgage debt by 89.5% and our total debt by 27.8%!

Even though we didn’t make much progress in the month of July, we were still on track to meet our long-term goal of paying off all of our debt, including our mortgage, by the time we turn 40. If we continue to reduce our debt at this rate (27.8% reduction in 24 months), we will pay off our debt by October 2020 when Mike is 40 and I am 39!

Goals for August

By the end of July, we knew we were moving forward and moving out!

Since we spent so little on groceries during the month of July and expected to be eating out a lot during the month of August to get through the move, we opted to reduce our grocery budget and increase our restaurant budget.

So our goals for the the month of August were:

- Stick to $400 budget for groceries,

- A $300 budget for restaurants,

- Survive the move, and enjoy our new home!

Final Thoughts

There was so much going on in June and July, it feels like it was only yesterday, but so much has happened since then.

Next week, I’ll be breaking down how we did with sticking to our goals for August and what we expect for the rest of the year.

Now I’d love to hear about you!

Did you stay on track with your financial goals during the summer, or did you splurge a little, like we did? Share in the comments below.

I have no idea how your feeding your family on 400 a month. Our family of 4 is spending 950 a month on groceries. My teenagers are literally eating our retirement 🙂

Oh no! We don’t have teenagers yet, but our grocery budget is something we’ve been struggling with. We have to keep a close eye on it to keep it in check.

Great progress and how awesome that you didn’t derail during the summer holidays!

Thanks, Ursula!

Sounds like a ton is going on! You’re still doing an awesome job though. Keep up the good work!

Thank you so much, Melanie! That means a lot! 🙂

Wow, what a great way to track all that you are doing and what a lot to do at one time. That grocery budget for 4 is seriously impressive, I may spend that a month for just me…..yikes

http://www.dawnehanks.com

Thanks, Dawne! Tracking where we spend our money has been THE most important habit for us. It helps us figure out what works and what we need to do better in the future to stay on path.

I love these updates! Thanks for sharing. We’ve had MANY unexpected budget busters this month, including major car repairs AND house siding work… when it rains, it pours!

Oh, my! Sorry to hear that, Marlynn. That’s where the emergency fund comes in! You never know what’s lurking around the corner.

The restaurant budget is a hard one to keep. For me, of course it’s a line item bigger than most people since I love food, but I then cut back on other luxuries like clothing purchases or entertainment. That’s half the point of a budget – it’s ok to try your best to stay within it, but if you can’t then you can adjust accordingly for your longer term goals. I’m glad to see you didn’t let it hold you back from celebrating special occasions!

I totally agree, Pech! Creating the budget is all about personal priorities. We don’t spend much on clothing and entertainment either. 🙂

Good for you for making progress in spite of such hectic changes! I haven’t been as careful about spending lately because our income increased. But our next big goal is to funnel a bunch more money into retirement!

Thanks, Catherine!

So awesome that your income has increased! Saving more for retirement is an awesome goal!

Tackling that student loan debt has really inspired my 2016 budget!!

Way to go, Meredith!

so inspiring! it makes me get excited about budgeting and paying off debt!

Thanks, Kelsey!

Super inspiring! Came here from FreedomHackers and signed up for your Jump Start Guide 🙂

Yay, Winnie! So glad you liked the post and downloaded the Jump Start Guide. 🙂 I’d love to hear what you think and how it helps you.