Each month I bring you a recap of the previous month’s progress on paying off our debt. This serves two purposes — to keep my husband Mike and me accountable to our financial goals and to give you a look behind the scenes of our strategy for paying off our debt.

My hope is that giving you this open and honest review will inspire you to keep going on your own debt free journey. Or if you haven’t started yet, I am hoping this information will help fuel your fire to get going on reaching your financial goals.

Don’t worry, I won’t go line by line through our budget. But I will give a rundown of things that happened during the month that affected our budget and point out some areas that worked and some that need improvement.

While we have already paid off a lot of debt in a short amount of time, you’ll find that our journey is not perfect in any way. When my husband and I review each month, we often discover opportunities we missed where we could have put more money toward our debt. We definitely make mistakes, and in retrospect, many times we will find situations where we have spent more money than necessary. But we don’t let these findings discourage us. We try to learn from our mistakes and use them to propel us forward into the next month.

Let’s take a look at how February 2015 went…

Our Financial Goals for February

You may remember from our January Debt Freedom Progress Report that we struggled with sticking to our grocery and restaurant budgets. Mike and I have been following the Paleo diet since the beginning of the year, which cuts out all processed foods and grains.

We have been loving the Paleo recipes from eMeals, our meal planning service, but purchasing so much meat and organic vegetables has been stressful on our budget.

With this in mind, I outlined our goals for the month of February as follows:

-

Pay $1,462.39 toward the HELOC,

-

Stick to $500 budget for groceries, and

-

Stick to $50 budget for restaurants.

What Went Well

We Stuck to Our Grocery and Restaurant Budgets

At the end of January, we learned that Mike was selected to attend a training program on the east coast for his work during the majority of the month of February. I don’t like to share publicly when Mike is gone for security reasons so I kept this information to myself when I wrote the January report.

However, I had a good feeling that with him out of town it would be easier to stick to our food budgets since his meals were included where he was staying.

Mike flew out on February 8th and returned home on February 28th. He was gone a full three weeks, and the kids and I missed him very much! While he wasn’t able to work any overtime during his trip, he did get compensated for his travel days.

With Mike not eating at home, each meal lasted a little longer, which meant that I didn’t need to cook or go grocery shopping as often as normal. While Mike and I are sticking to the Paleo diet, our kids are still eating some grains. For their meals, I focused on using what we had in the pantry, which also helped to keep our grocery costs down.

Regarding our restaurant budget, the kids and I did not eat out at all during the month of February! Mike did eat out a few times on his trip, but those meals were funded with his spending money (which we keep as a separate category in our budget) since he could have eaten for free at the café where he was staying.

However, we did include his meal at the airport in our restaurant budget, but we easily stayed within our goal amount of $50.

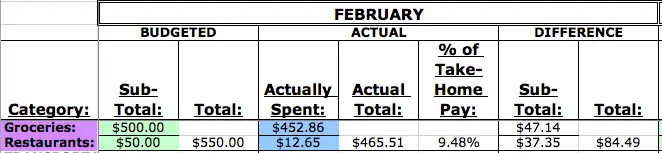

Here are the final numbers for our grocery and restaurant budgets for the month of February straight from our budget spreadsheet:

We came in $84.49 under budget for our food categories!

What Didn’t Go As Planned

More Expenses for the Blog

In our January report I discussed how we had some unexpected expenses due to launching the website and how we don’t expect to have any more large expenses for the website going forward.

Well, I was wrong.

In an effort to be completely candid, I want to share with you that I have joined an online program that will help me turn my blog into a business.

I am so passionate about spreading the message that life without debt is achievable, and I know that there are a lot of people who need to hear this message. I feel compelled to do whatever I can to help as many people as possible break free from debt and work toward true financial freedom.

I currently offer free information on the blog and a free ebook to guide people on their journey, and I will continue to offer free resources. But the truth is that some people will only take action if they have some “skin in the game” so-to-speak and have paid money to help them move forward.

Plus, it would be nice to be compensated for the time and money that my family and I have invested in this endeavor. Doing so will not only help our family reach our financial goals faster, but I will be able to re-invest some of my earnings back into the business to make even more of an impact in the world.

While I will continue to provide free content through my blog, I plan to create online products and programs that will further help people take control of their money, get out of debt, and work toward true financial freedom.

Therefore, I have joined Marie Forleo’s B-School. If you are familiar with the program, then you know that it is quite expensive. The investment was $1,999.00, and the decision to spend that money and join was a difficult one for my husband and me.

Prior to the month of February, I had heard of B-School, and I was definitely interested, but I thought there was no way that I could spend that kind of money on an online program, especially before I had started to earn an income from my website. However, during the month of February, I learned more about B-School from Marie and Amy Porterfield, two online entrepreneurs whom I look up to greatly. Amy was a student of Marie’s and has been very open about how B-School helped her grow her small business to a multi-million dollar business in just a few years.

Enrollment for 2015 was only open until the beginning of March so I had to act fast. Mike and I discussed the decision in great length and decided to use our tax refunds to cover the cost. Once Mike returned from his trip, we quickly submitted our taxes and found that our tax refunds would more than cover the cost.

I am fortunate to have such a supportive husband who believes in me and encourages me to pursue my dreams, but we did not make this decision lightly.

I am devoted to spreading my message and helping as many people as possible, and I believe that B-School will give me the guidance to do so on a larger scale and much more quickly than on my own.

We Didn’t Make Much Progress on Our Debt Snowball

Unfortunately, even though we stuck within our budget for most categories, due to the unexpected expense of joining B-School, we were not able to make any extra payments toward our home equity line of credit (HELOC).

In the month of February, we reduced our non-mortgage debt by only 0.03% and our total debt by only 0.16%. Since we started our plan back in August 2013, we have reduced our non-mortgage debt by 78% and our total debt by 24%.

Even though we didn’t make much progress in the month of February, we are still on track to meet our long-term goal of paying off all of our debt, including our mortgage, by the time we turn 40. If we continue to reduce our debt at this rate (24% reduction in 19 months), we will pay off our debt by February when Mike is 39 and I am 38!

Goals for March

While we didn’t make much progress toward paying off our debt during the month of February, we were better about sticking to our food budgets. Now that Mike is home, and we are feeding our whole family again, we will have to be more mindful about sticking to our grocery and restaurant budgets.

We are expecting to receive our tax refunds this month, but until we do, I do not include them in our numbers for our spending plan.

For our March goals, I am also including the items that we still have yet to complete on our own checklist for a strong financial plan. We have a couple of items that are missing, and we are committed to checking those off the list this month.

Here are our goals for the the month of March:

-

Pay $1,438.64 toward the HELOC,

-

Stick to a $500 budget for groceries,

-

Stick to a $50 budget for restaurants,

-

Write our wills, and

-

Get disability insurance for Mike.

Final Thoughts

Once again the month did not go as expected, but life rarely does. It is still important to plan for what you can and expect that there will be times when something comes up that throws your plan off course.

When this happens, the best thing we can do is accept the past, get back on track, and keep pushing forward toward our goals.

What About You?

Participate in the conversation. How did you do on your February goals? What are your goals for March? Share in the comments below.

Another great post! I hadn’t seen the financial plan checklist before, but it’s got some great things that I never think about. At 25 I didn’t see the need to have an sort of plan, but I started building my emergency fund after I had to go on short term disability at work and while I was getting paid, it wasn’t a full check which definitely caused me stress. Also, love the Lewis Carroll quote. Thanks for sharing!

Thank you! That would definitely be a stressful situation if you’re not prepared. I’m glad you found value in the checklist and that you’re building your emergency fund.

HI there, this is the first time I’ve visited your blog and I just subscribed and look forward to your your posts. I am also working on building my blogging business and know unexpected expenses all too well. We have also used a consulting company and are familiar with the costs/time associated. Never hesitate to reach out! http://www.YesSpaces.com

Thanks, Barbara! I appreciate you stopping by. 🙂

Congrats on sticking to the grocery and dining out budgets! And, congrats on signing up for Marie Forleo’s B-School. I love her, and have heard great things about it. Looking forward to hearing your perspective and experience in her program.

Thanks, Marlynn! I will definitely be sharing how it goes. So far I am really impressed, and it is helping me to clarify my goals for the business.

I’ve never heard of the B-School, but I’m glad to hear you made the decision and investment in yourself and this blog, and that your tax refund will cover the cost so although it takes a bite from paying down debt, you also are not making any new debt AND making an investment!

Thanks, Pech! My thoughts exactly! 🙂

This has inspired me to start a budget document of my own to see and learn more about and educate myself about my spending habits! Thanks for sharing

Yay! I am so excited for you, Rachel! I have worksheets you can use in the back of my free guide, Jump Start Your Way Out of Debt, to help you get started. Let me know if you have any questions. 🙂

Life is dynamic, hence the changes and challenges we all face are opportunities for growth. Looking forward to seeing the results of your schooling 🙂

Thanks for your support, Candace! I will keep you posted. 🙂

Congratulations on investing in your business!

Thank you, Meredith! I am really enjoying B-School so far.

this is so helpful and interesting to read! i’m about to embark upon a debt reduction goal and this demonstrates how achievable it is with planning and careful attention to finances!

I am so glad that you found this helpful, Kelsey! Let me know if I can help in any way or if you have any questions getting started.

Life without debt is a good message and worth the investment. I’ve been telling my friends that for years. I also tell them to do Christmas or Holiday shopping year-round to avoid the stress and financial problems in December. They all think it’s a good idea, yet they give me a hard time for boasting that my shopping is done by Thanksgiving each year. LOL?

That’s great advice, Bill! Why stress on December 23rd when you can plan all year for what to get everyone?