10 Must-Try Investment Apps to Grow Your Wealth in 2025

Investing your hard-earned money has never been easier, thanks to the numerous apps available that can help you grow your wealth in 2025. With the right app, you can start investing with minimal fees, access powerful tools, and even automate your investment strategy. Whether you are just getting started or looking to take your financial portfolio to the next level, here are ten must-try investment apps that can help you achieve your financial goals.

1. Robinhood: Commission-Free Trading for Everyone

Robinhood revolutionized the investment landscape by offering commission-free trading on stocks, ETFs, options, and even cryptocurrencies. Its sleek, user-friendly design makes it an excellent choice for both beginners and more experienced investors. You can start investing with as little as a few dollars thanks to fractional shares, allowing you to diversify your portfolio without needing a large initial investment. However, keep in mind that the app lacks some advanced research tools, so it may not be suitable for investors seeking more in-depth analysis. Overall, Robinhood is perfect for those looking to invest without breaking the bank.

2. Acorns: Make Your Spare Change Work for You

Acorns is a fantastic option for people who want to invest passively. It automatically rounds up your everyday purchases to the nearest dollar and invests that spare change into a diversified portfolio. This micro-investing approach is perfect for beginners or anyone looking to start small. Acorns also offers features like retirement accounts (IRAs) and recurring contributions, so you can set it and forget it. However, it does come with a small monthly fee, which may not make sense for those with smaller balances. Still, it’s an excellent way to begin your investment journey without much effort.

3. Betterment: Robo-Advisor for Hands-Off Investors

Betterment is one of the leading robo-advisors in the market, offering automated portfolio management that aligns with your goals and risk tolerance. With Betterment, you don’t have to worry about constantly rebalancing your portfolio or researching new investments. The app does it all for you, using modern portfolio theory to optimize returns. You can also access a suite of tax strategies and financial planning tools. While the management fees are reasonable, Betterment does have higher fees for more advanced services. If you prefer a hands-off approach to investing, Betterment is an excellent option for you.

4. E*TRADE: A Platform for All Types of Investors

ETRADE is a versatile investment app that caters to all types of investors, from beginners to experts. It offers access to stocks, bonds, ETFs, mutual funds, and more. The platform has powerful research tools, educational resources, and even retirement planning features. ETRADE also offers commission-free trading for stocks and ETFs, which makes it a cost-effective choice. However, there are some fees for certain transactions, such as options contracts. Overall, E*TRADE is great for those who want a comprehensive and well-rounded investment app.

5. M1 Finance: Customizable Portfolios with Automated Management

M1 Finance is a game-changer for investors who want more control over their portfolios. It allows you to create personalized portfolios, known as “Pies,” and then automates the rest. Whether you want to invest in individual stocks or exchange-traded funds (ETFs), M1 Finance makes it simple to create a portfolio that aligns with your goals. The app also offers automatic rebalancing and commission-free trading. However, M1 Finance requires a minimum investment of $100 for taxable accounts, so it’s not the best fit for those just starting with a small amount of money. For those who want both customization and automation, M1 Finance is a fantastic option.

6. Wealthfront: A Comprehensive Robo-Advisor

Wealthfront is another excellent robo-advisor that offers a similar experience to Betterment. The app automates your investment strategy by allocating your funds across a diversified portfolio, using algorithms to ensure your investments are aligned with your long-term goals. Wealthfront also offers tax-loss harvesting and financial planning tools, which is great for those looking to minimize taxes on their investment gains. The platform charges a small management fee, and there is a $500 minimum investment required. Wealthfront is perfect for investors looking for a completely hands-off, low-cost investing solution.

7. Fidelity Investments: Trusted for Retirement Accounts and More

Fidelity Investments is a well-established name in the investment world, and its app offers everything you need to build and manage your portfolio. Fidelity provides access to a wide range of investment options, including stocks, ETFs, mutual funds, and retirement accounts. The platform is known for its excellent customer service and robust educational resources, making it a great choice for beginners. Additionally, Fidelity offers zero-fee trading on many transactions, which keeps costs low. However, if you’re after more advanced features like options trading, you may find the app a little lacking. Overall, Fidelity is an excellent choice for those looking to invest in both traditional and retirement accounts.

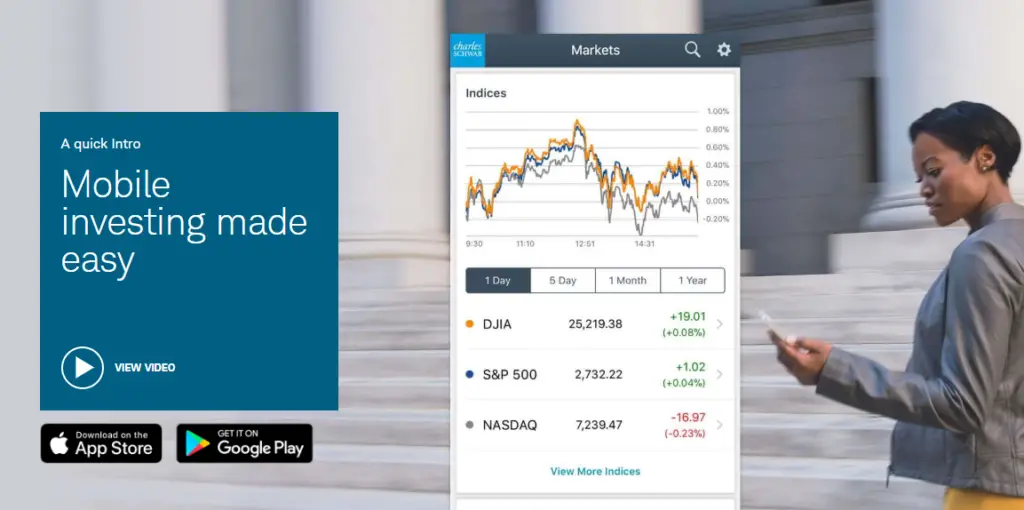

8. Charles Schwab: Commission-Free Trading with Exceptional Support

Charles Schwab is a top-tier investment platform that offers commission-free trading on stocks, ETFs, and options. The app also provides access to a wide variety of research tools and educational resources, which can help you make better investment decisions. Charles Schwab is ideal for both new investors and seasoned professionals due to its low-cost structure and top-notch customer support. It’s particularly well-suited for those looking to invest in retirement accounts like IRAs and 401(k)s. While the platform is easy to use, it may not be as feature-rich as some other apps for active traders. Still, it’s an excellent all-around choice for investing.

9. Stash: Invest in Your Future with Fractional Shares

Stash is another investment app that makes it easy to start investing with as little as $5. It offers fractional share investing, allowing you to own a piece of stocks that may otherwise be too expensive. The app also provides personalized recommendations based on your financial goals, making it perfect for beginners. Stash offers a monthly fee structure that can add up for smaller portfolios, but it’s a great option if you’re just starting out and want a simple way to build your wealth over time. The app also includes educational content, so you can learn while you invest.

10. Public: Social Investing with a Twist

Public is an innovative investment app that combines commission-free trading with social investing. This platform allows you to see and discuss investments with others, making it a great option for those who enjoy sharing and learning from a community. Public offers fractional shares, so you don’t need a lot of money to get started. The app also offers educational content to help you make informed decisions. With no fees for trades, Public is perfect for anyone who wants to invest with no added costs. However, keep in mind that the social aspect may not appeal to everyone, especially those who prefer more privacy.

Final Thoughts

Choosing the right investment app depends on your individual goals, risk tolerance, and preferred level of involvement. Some platforms are ideal for beginners looking to start small and learn as they go, while others are better suited for seasoned investors who want more control over their portfolios. Regardless of your experience level, there’s an app that can help you grow your wealth in 2025. Always consider fees, investment options, and features before choosing an app. And remember, the best app is one that aligns with your financial goals, whether you’re looking to invest passively or actively manage your investments. Investing is a long-term game, and with the right tools, you can set yourself up for financial success in the years to come. Happy investing!

Leave a Reply