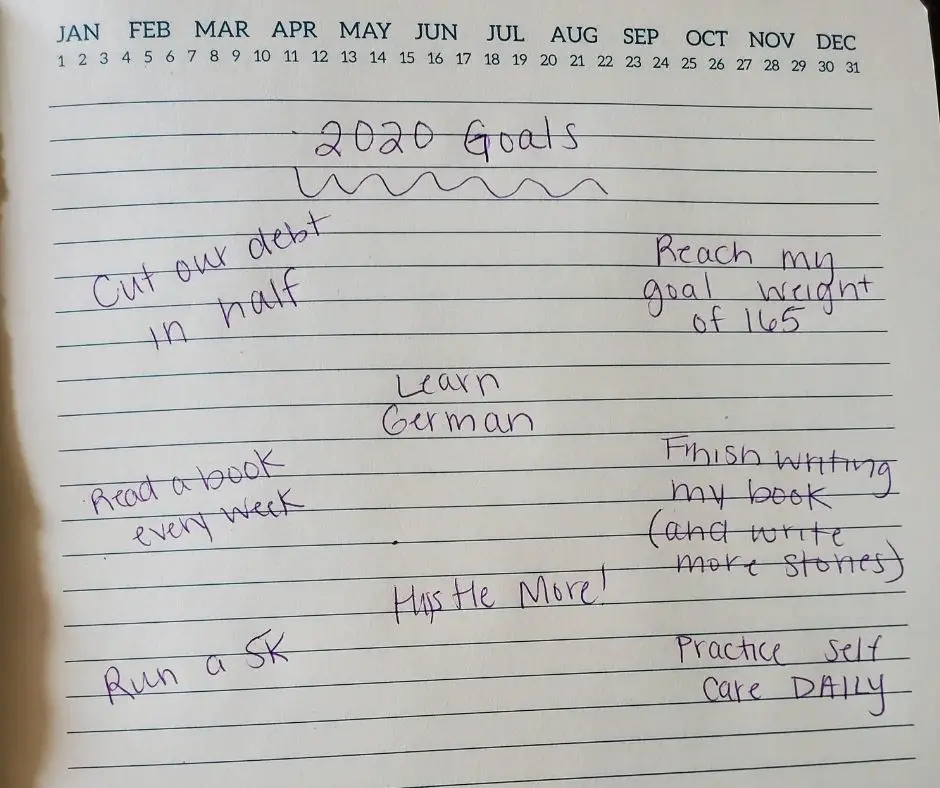

More people than ever a resolving to be more financially healthy in the coming 12 months than ever. Each year, we typically sit down and list out our goals. Things like “lose 20 pounds,” and “save $1,000” usually frequent such lists. However, in the personal finance world, I have seen some really amazing (some lofty) debt resolutions for the new year. Honestly, they are inspiring. It made me sit down and reflect on what my resolutions for 2020 were.

Resolutions for the New Year

When 2020 began, I had some pretty hefty resolutions, as many people do. None of us expected COVID to derail our plans. Financially, I’m glad to have been able to pay my rent for all 12 months this year. I am glad to have had a little money in my bank account at all times. More importantly, we haven’t accrued any new debt. When it comes to having met last year’s goals though, there was a valiant effort made.

As far as cutting our debt in half, that did not happen this year. We were on one income for most of the year and were doing good to make minimum payments. The bigger deal is that we did not accrue any new debt. Both of us hustled more this year with side work, freelance, and other opportunities where we could make money. That goal was definitely met.

The others on the list, well…

I did not reach my goal weight, nor did I finish my novel, or run a 5K. I did learn some German (though I’m not fluent) and I read more this year (40 books in total). I also took a few minutes every day to practice some sort of self-care: goal met. While these may not seem like a huge deal, they were things that significantly improved 2020 for me.

Debt Resolutions for the New year

Now, for my finances in 2021, I’m hesitant to make any big debt resolutions or financial goals. When it boils down to it, I don’t know what the next 12 months will bring us in terms of our money. My husband is starting a new job next week, so we will have an additional income. For the first three months of the year, we will be tying up any loose ends in Atlanta, taking care of things like tires for the car and maintenance items, and getting fully settled in our new home.

After that, we plan to focus on snowballing every extra penny we have towards our debt. In essence, my husband’s new salary should all be additional debt payment cash (whew!). I’m excited about the potential for change for us, but hesitant to be too optimistic, as I am sure many people are feeling right now.

2020 changed a lot of people’s ability to look forward and plan things like debt goals for the next 12 months. For most people, it is hard to plan for anything more than 30 days in advance. So, for now, we are taking everything in stride. I can’t wait to keep you updated on our progress through the next year.

Readers, are you making any debt resolutions for 2022? Are you finding it difficult to look forward to the next year too?

Leave a Reply