Everyone has a way they like to organize their financial plan. For some, it is easier to log everything into a spreadsheet. Others have started using apps to manage their cash. In our family, we use a budget calendar to stay on top of our finances.

Our Budget Calendar

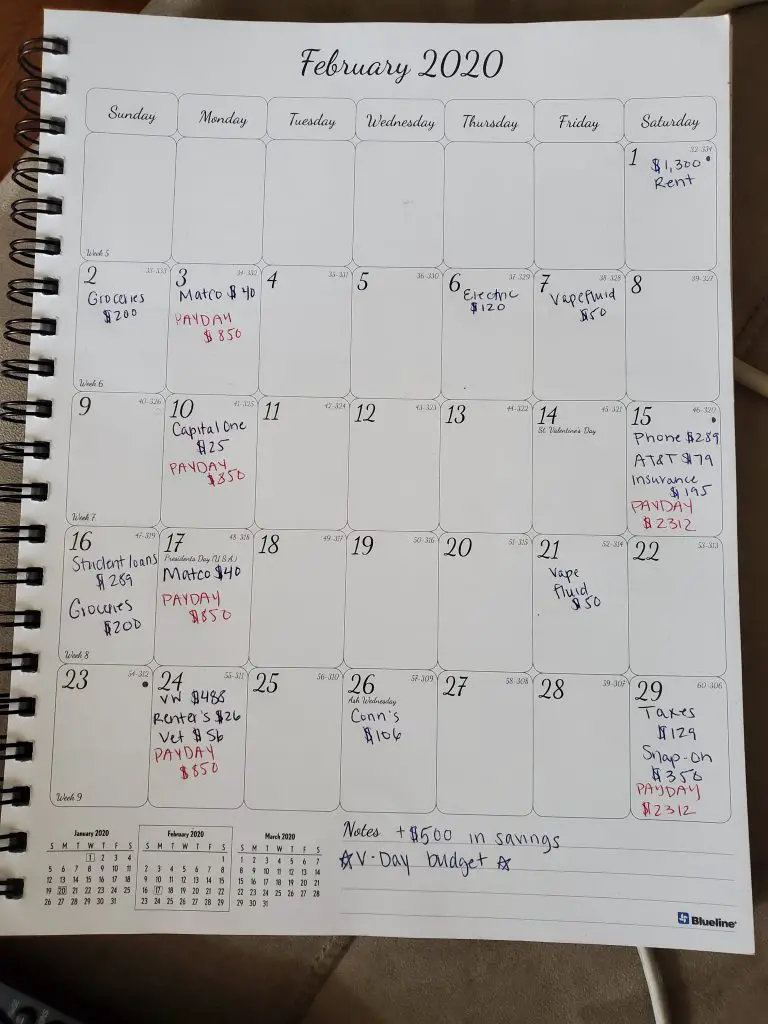

While writing everything down on a calendar may seem a bit old-fashioned, it can work really well, especially if you do better with writing things down. I personally still keep a physical calendar for everything, so adding our budget into it made complete sense. Here’s what ours looks like…

As you can see above, I have color-coded what money we have going in and what we have going out every week. Our paydays are written in red and all of the money going out is written in blue. This includes all of our bills, groceries, and my hubby’s vape fluid for the month. As you can see, there is also a note to have money budgeted for Valentine’s Day as well as $500 into savings.

Creating Your Own

If you’d like to create your own budget calendar, it is really easy. All you need is a monthly calendar layout (you can even do this on your computer if you prefer). Once you have your bills and earnings written out on the calendar, you can decide how much money you can budget towards entertainment and additional debt payments.

Of course, everyone’s budget calendar is going to be different. If you have a larger family, you’ll spend more on food. People who have more debt may also have more monthly payments to consider on their personal calendars. As you begin to pay things off, you can always change your budget because you’ll be jotting down your expenses and earnings every month as it changes.

Also, it is a good idea to set aside a day every month to review your budget and see what the month ahead will bring for you financially. Be sure to also note any large, one-time expenses that may occur, like paying taxes or renewing your car’s registration.

Readers, do you use a budget calendar? If not, what kind of budgeting method do you use?

Leave a Reply