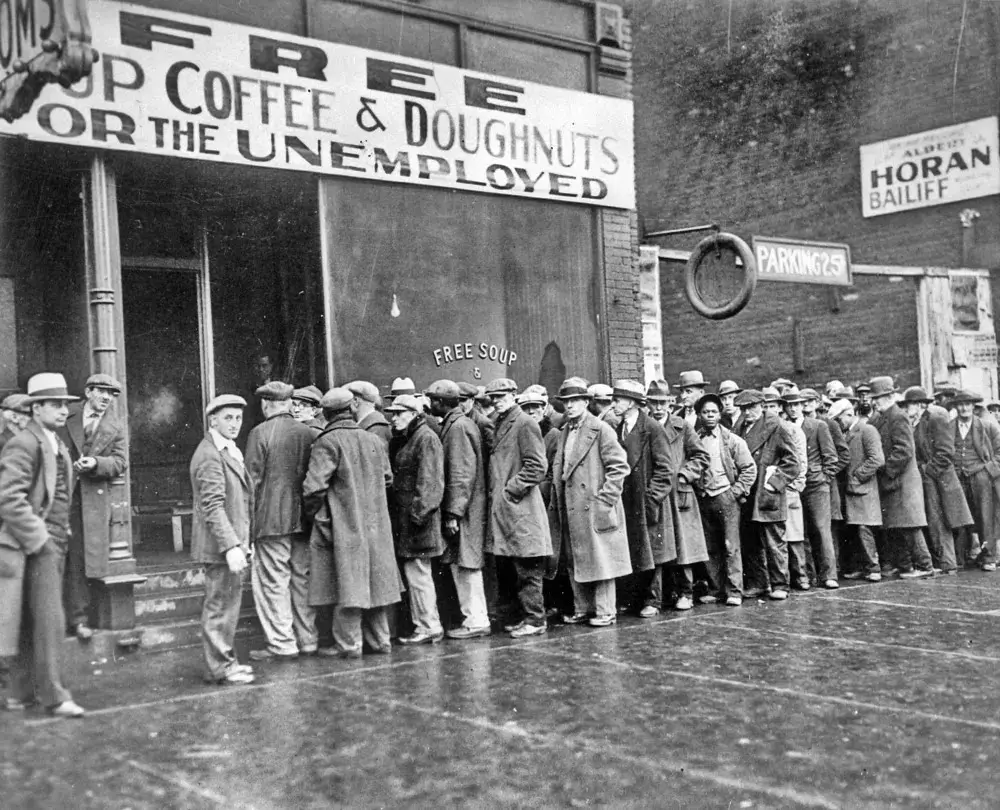

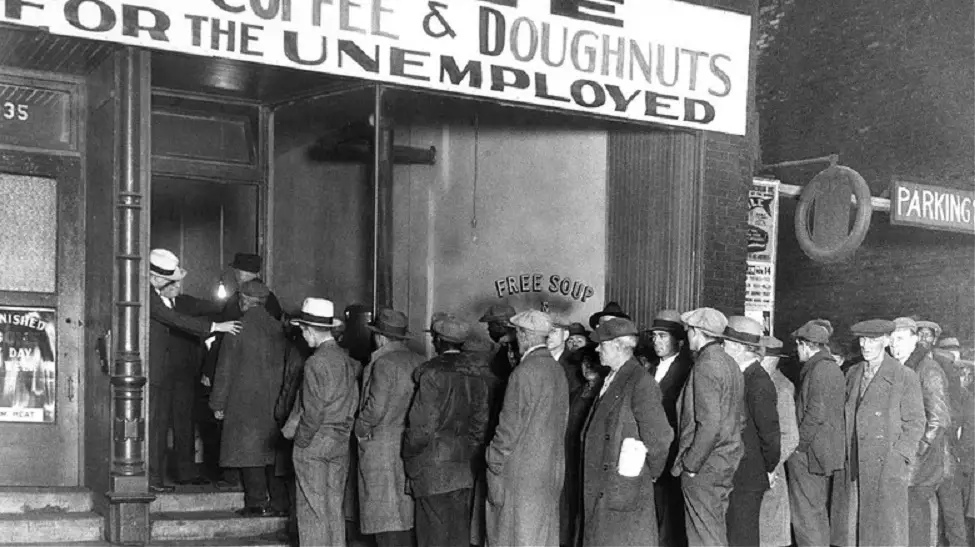

8 Iconic Retail Chains Struggling to Survive—Is Your Favorite on the List?

The U.S. retail landscape is undergoing significant transformations, with several iconic chains facing unprecedented challenges. Factors such as declining foot traffic, shifts in consumer behavior toward online shopping, and economic pressures have placed these retailers in precarious positions. Below, we explore eight renowned retail chains currently struggling to survive, delving into their financial woes, reasons for store closures, and their longstanding histories.

1. Big Lots

Established in 1967, Big Lots has been a prominent discount retailer for over 50 years. In September 2024, the company filed for Chapter 11 bankruptcy and announced plans to close all 963 remaining stores, following a $1.7 billion loss in the fourth quarter of 2024. Factors contributing to its decline include inflation, high operational costs, and a shift toward online shopping, which have eroded Big Lots’ customer base.

2. Dollar Tree

Since its inception in 1986, Dollar Tree has been a go-to for affordable household items for nearly four decades. The company plans to shut down 1,000 stores due to significant losses, including a $1.7 billion loss in the fourth quarter of 2024. This includes the closure of 370 Family Dollar and 30 Dollar Tree stores. The problematic acquisition of Family Dollar for $8 billion nearly a decade ago has been a significant burden. Additionally, sustained high interest rates, inflation, and a consumer shift toward “fast fashion” and e-commerce have negatively impacted sales.

3. Party City

Established in 1986, Party City has been the go-to retailer for party supplies for nearly four decades. The company filed for bankruptcy in January 2023 and again in December 2024, leading to the closure of all company-owned stores. Increased competition from online retailers and declining in-store sales have significantly impacted Party City’s financial stability.

4. Bed Bath & Beyond

Founded in 1971, Bed Bath & Beyond was a leading home goods retailer for over five decades. The company filed for Chapter 11 bankruptcy in April 2023, citing declining sales, high debt, and an inability to adapt to the e-commerce boom. All remaining stores were closed by July 2023, marking the end of an era for the once-dominant retailer.

5. Rite Aid

Established in 1962, Rite Aid has been a prominent pharmacy chain in the United States. The company filed for bankruptcy in 2023, leading to the closure of hundreds of stores. Financial struggles stemmed from mounting debt and increased competition from larger rivals and online pharmacies.

6. Jo-Ann Stores

Founded in 1943, Jo-Ann has been a leading fabric and craft retailer for over 80 years. The company filed for Chapter 11 bankruptcy protection for the second time in January 2025. Plans include closing 500 of its remaining 800 locations to “right-size” its footprint. Declining sales, increased competition from online retailers, and changing consumer habits have severely impacted Jo-Ann’s profitability. The company’s inability to adapt to the digital marketplace has further exacerbated its financial woes.

7. Walgreens

Established in 1901, Walgreens has been a cornerstone in the pharmacy retail sector for over a century. The company has faced considerable challenges, transitioning from a significant healthcare giant to a private-equity salvage project. Walgreens struggled as consumers increasingly preferred online shopping, neglecting to keep up with customer trends and competition.

8. Foot Locker

Founded in 1974, Foot Locker has been a leading retailer in athletic footwear and apparel for over 50 years. The company announced plans to close 400 stores by 2026. The rise of direct-to-consumer sales by major athletic brands and the increasing popularity of online shopping have reduced the need for traditional retail intermediaries like Foot Locker.

Final Thoughts

The struggles of these iconic retail chains underscore the profound shifts occurring in the retail industry. Economic pressures, changing consumer behaviors, and the rise of e-commerce have challenged traditional business models. As these retailers attempt to navigate these challenges, their experiences highlight the need for adaptation and innovation in an ever-evolving marketplace.