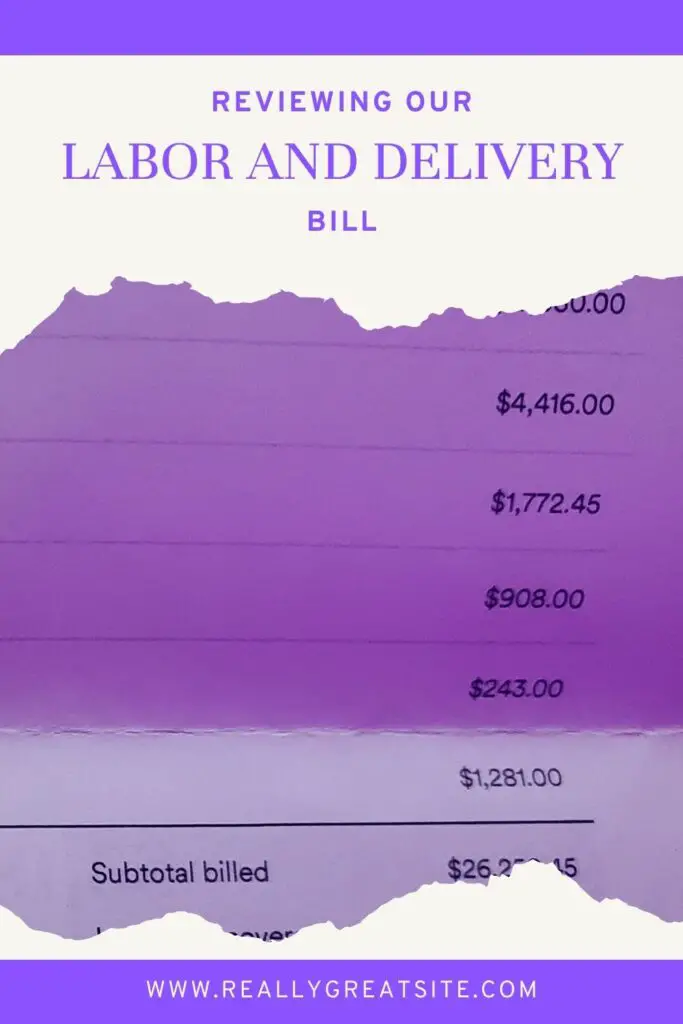

Mike and I spent almost $2,000 on gifts this year.

$1,979.24 to be exact.

And that was under budget.

That amount doesn’t include the tithes we gave to our church and other donations.

$1,979.24 only includes how much we spent on gifts for birthdays, Christmas, Father’s Day, Mother’s Day, and a few weddings. Since we have been focusing on paying off our debt, we gave gifts only to close family and friends.

We all know at least one person that takes being “a penny pincher” to a whole new level. The ones that buy the cheapest toilet paper and pull the 2 sheets apart to make 2 rolls or the one that buys paper plates and tries to wash them.

We all know at least one person that takes being “a penny pincher” to a whole new level. The ones that buy the cheapest toilet paper and pull the 2 sheets apart to make 2 rolls or the one that buys paper plates and tries to wash them.