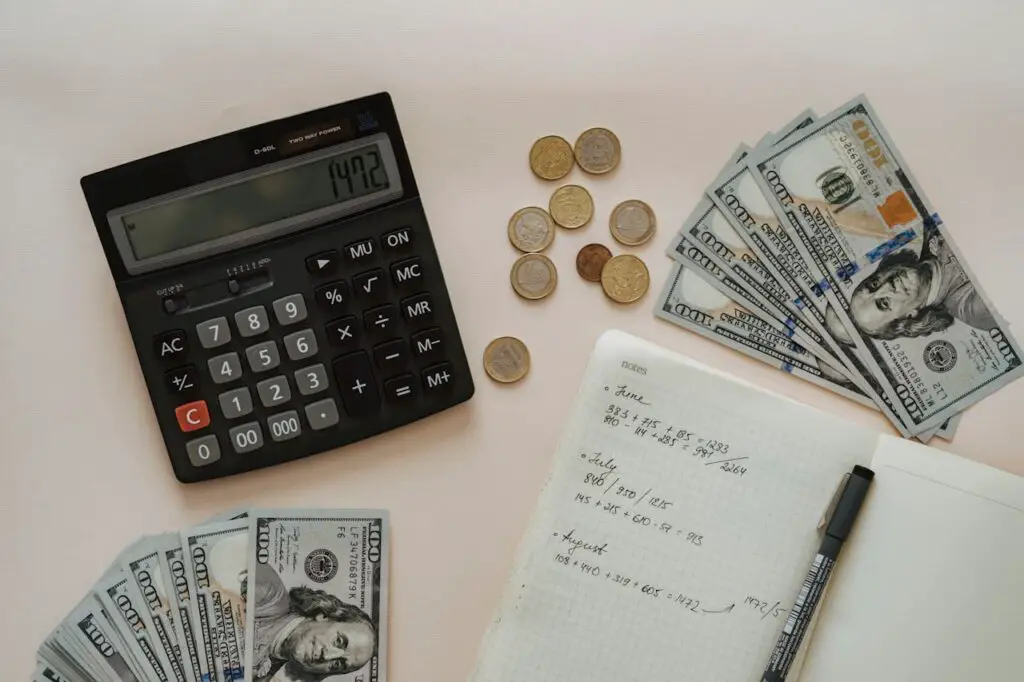

9 Everyday Expenses That Have Become Too Costly—and How You Can Cut Back

Are you feeling the pinch of rising prices? You’re not alone. Everyday expenses that once seemed manageable have become more expensive, making it harder to stick to a budget and save for the future. From grocery bills to transportation costs, it’s easy to feel overwhelmed by the constant increase in prices. But don’t worry—there are simple ways to cut back without sacrificing your lifestyle. In this blog, we’ll highlight nine everyday expenses that have become too costly and share practical tips on how to reduce them. Let’s dive in!

1. Groceries: How to Keep Your Grocery Bill Under Control

Grocery prices have surged in recent years, with basic items like bread, milk, and vegetables costing significantly more. For many families, this is one of the most noticeable changes in their monthly budget. To reduce your grocery bill, try shopping in bulk, using coupons, and opting for store brands instead of name brands. Meal planning is another great way to save—by planning meals ahead of time and cooking in batches, you can avoid impulse buys and reduce food waste. Additionally, consider shopping at discount stores or farmers’ markets, where prices are often lower than at traditional supermarkets.

2. Gasoline: Tips for Cutting Back on Fuel Costs

The cost of gasoline is something most people can’t avoid, especially if you have a long commute or need to drive frequently. With prices fluctuating, it’s easy for fuel costs to eat up a large portion of your budget. To cut back, consider carpooling with friends or coworkers to share the cost of commuting. Public transportation is another affordable option, and if it’s available in your area, it can save you a significant amount each month. If you drive often, think about driving a more fuel-efficient car or even switching to an electric vehicle to lower your overall fuel costs.

3. Dining Out: Why Eating at Home Is More Budget-Friendly

Dining out is a treat, but it can quickly become an expensive habit. A simple dinner out for two can easily cost $50 or more, and if you’re eating out several times a week, the costs add up fast. To save money, try cooking at home more often. Not only is it cheaper, but it can also be healthier. If you love dining out, consider limiting your trips to once or twice a month, or choose less expensive options like takeout or fast-casual restaurants. Look for deals and discounts at your favorite spots to make dining out more affordable.

4. Subscription Services: Are You Paying for Services You Don’t Use?

Subscriptions are convenient, but they can also be a major drain on your finances if you’re not keeping track. From streaming services to fitness apps and beauty boxes, many people are unknowingly paying for subscriptions they no longer use or need. To cut back, review your subscriptions and cancel any that aren’t adding value to your life. If you’re paying for multiple streaming services, consider rotating them to avoid paying for too many at once. You can also explore free alternatives like library services for books and movies or free workout videos online.

5. Utilities: Save Money on Electricity, Water, and Heating

Utility bills are another area where costs are rising. Whether it’s electricity, water, or heating, these essential services can take up a significant portion of your budget. To reduce utility costs, start by making your home more energy-efficient. Switch to LED bulbs, install a smart thermostat, and seal any drafts around doors and windows to keep your home warm in winter and cool in summer. Reducing your water usage, such as taking shorter showers and fixing leaks, can also lead to savings. Be mindful of your energy consumption—turn off lights when not in use and unplug devices that draw power even when they’re turned off.

6. Healthcare: How to Manage Rising Medical Costs

Healthcare costs are on the rise, from insurance premiums to copays and out-of-pocket expenses for prescriptions. These costs can quickly add up and take a bite out of your budget. To save on healthcare, review your insurance plan during open enrollment to ensure you’re getting the best coverage for your needs. Compare prescription prices at different pharmacies and ask your doctor about generic alternatives. Preventative care is also key—regular exercise, a balanced diet, and routine checkups can help you avoid costly medical treatments down the line.

7. Childcare: Lowering the Costs of Daycare and After-School Programs

For working parents, childcare is often one of the largest monthly expenses. Whether it’s daycare, preschool, or after-school care, the costs can add up quickly. To cut back on childcare expenses, consider sharing duties with a trusted friend or family member. You could also explore more affordable after-school programs or look for government assistance programs that can help with childcare costs. If possible, work with your employer to explore flexible working hours or the option to work from home, which could help reduce the need for full-time childcare.

8. Clothing: How to Stay Stylish Without Breaking the Bank

Fashion trends come and go, but buying new clothes constantly can drain your wallet. Fast fashion is particularly tempting, but it often leads to purchasing items you wear only once or twice. To cut back on clothing expenses, focus on buying high-quality, timeless pieces that you can mix and match. Thrift stores, consignment shops, and online secondhand markets are great places to find stylish items at a fraction of the cost. Additionally, consider repairing or upcycling old clothes instead of constantly buying new ones.

9. Transportation: Save Money on Car Maintenance and Insurance

Owning a car comes with many ongoing expenses, including gas, maintenance, insurance, and registration fees. These costs can quickly add up, especially if you’re not staying on top of regular maintenance. To save money, opt for a fuel-efficient vehicle or consider downsizing to a car with lower insurance premiums. Regular maintenance, like oil changes and tire rotations, can help prevent expensive repairs later on. If you don’t need to drive every day, consider using ride-sharing services or walking to reduce wear and tear on your car.

Final Thoughts

Rising costs can feel overwhelming, but the good news is that small changes in your daily habits can add up to significant savings. By rethinking your spending on groceries, dining out, subscriptions, and other everyday expenses, you can reduce your monthly costs without sacrificing your lifestyle. Start by taking a close look at your spending and identifying areas where you can cut back. With a little effort and planning, you’ll be able to regain control of your budget and enjoy more financial freedom.

By making these simple adjustments, you can free up money for the things that matter most to you—whether that’s saving for the future, investing in experiences, or simply enjoying life without the constant worry of rising costs.