10 Budgeting Tools and Apps for Managing Your Money Like a Pro

Managing your finances can often feel daunting, but the right budgeting tools and apps can empower you to take control of your money with ease. Whether you are looking to track spending, save for a future goal, or pay down debt, there are numerous options designed to simplify your financial journey. In this article, we will explore 10 budgeting tools and apps that can help you manage your finances more efficiently, allowing you to make informed decisions and work toward your financial goals.

1. Mint

Mint stands out as one of the most popular budgeting apps, offering a user-friendly interface packed with powerful features. By linking your bank accounts, credit cards, and investments, Mint automatically tracks your spending, categorizes your transactions, and provides insights into your financial habits. This app helps you set budgets for various categories and sends alerts when you are approaching your limits. With a clear overview of your net worth, Mint allows you to monitor your financial progress over time, making it easier to stay on track.

2. YNAB (You Need a Budget)

YNAB is designed to help you take charge of your finances through a proactive budgeting approach. This app emphasizes the importance of assigning every dollar you earn to specific categories, ensuring you prioritize essential expenses while saving for future goals. YNAB offers educational resources and workshops to help users adopt effective budgeting strategies. With real-time spending tracking and bank account synchronization, YNAB keeps you accountable and motivated on your financial journey.

3. PocketGuard

PocketGuard simplifies the budgeting process by providing a clear picture of how much money you can spend after accounting for bills, savings goals, and necessary expenses. Once you link your accounts, the app calculates your “In My Pocket” amount, indicating how much you can spend without going over budget. PocketGuard also categorizes your spending, tracks recurring bills, and allows you to set savings goals, making it a fantastic option for anyone looking to streamline their financial management.

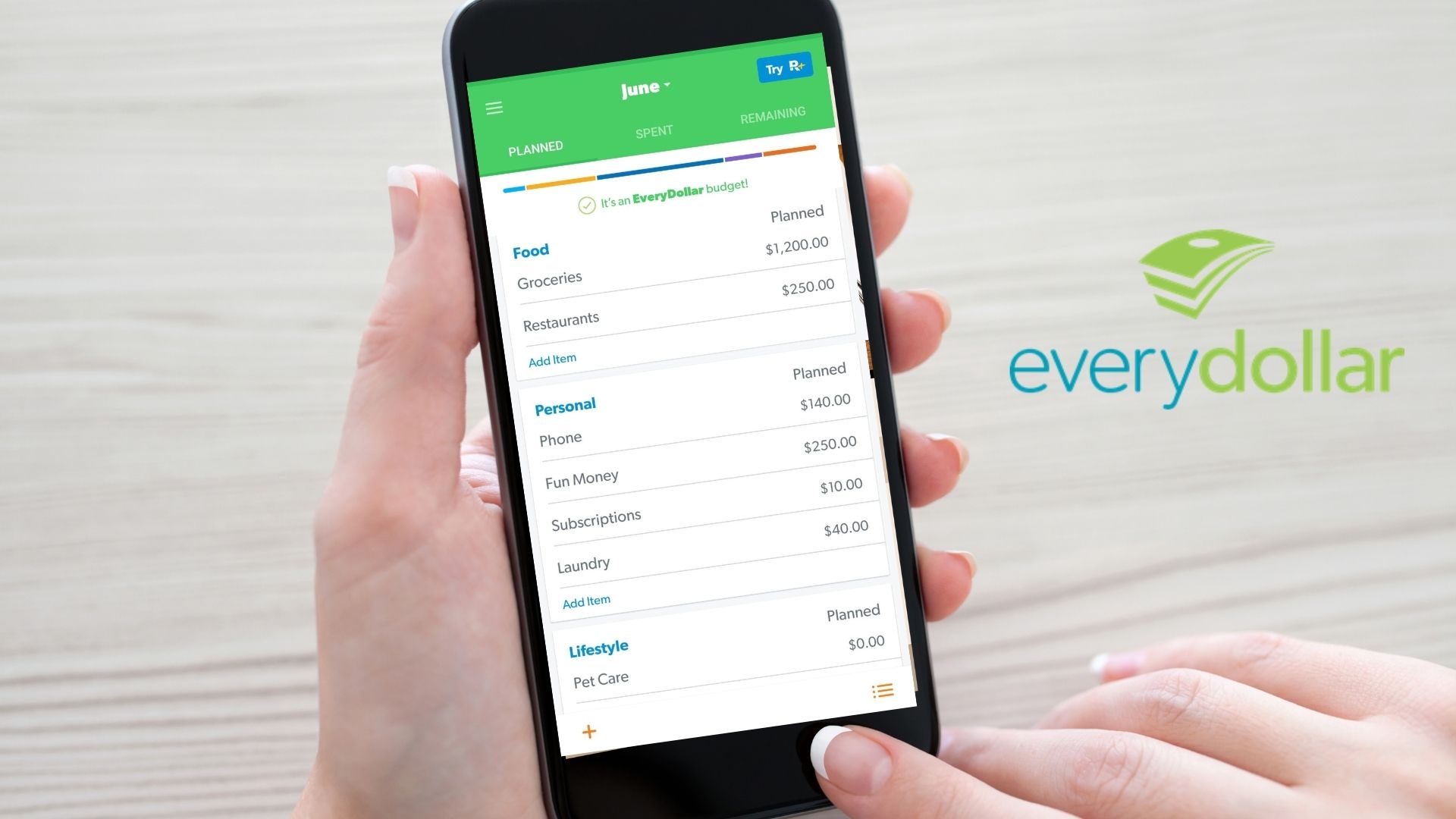

4. EveryDollar

EveryDollar, created by personal finance expert Dave Ramsey, is a zero-based budgeting app that encourages users to allocate every dollar of their income to specific expenses. The app allows you to create custom budgets and track your spending effortlessly. Its user-friendly design makes it accessible for beginners, while the premium version offers bank account synchronization, automating transaction tracking and categorization to keep you even more organized.

5. GoodBudget

GoodBudget brings the traditional envelope budgeting method into the digital age, allowing you to manage your finances using virtual envelopes instead of cash. You can create envelopes for different spending categories, track your income, and set budgets accordingly. GoodBudget provides features like transaction tracking, expense reports, and multi-device synchronization, making it an excellent choice for households looking to manage their finances collaboratively.

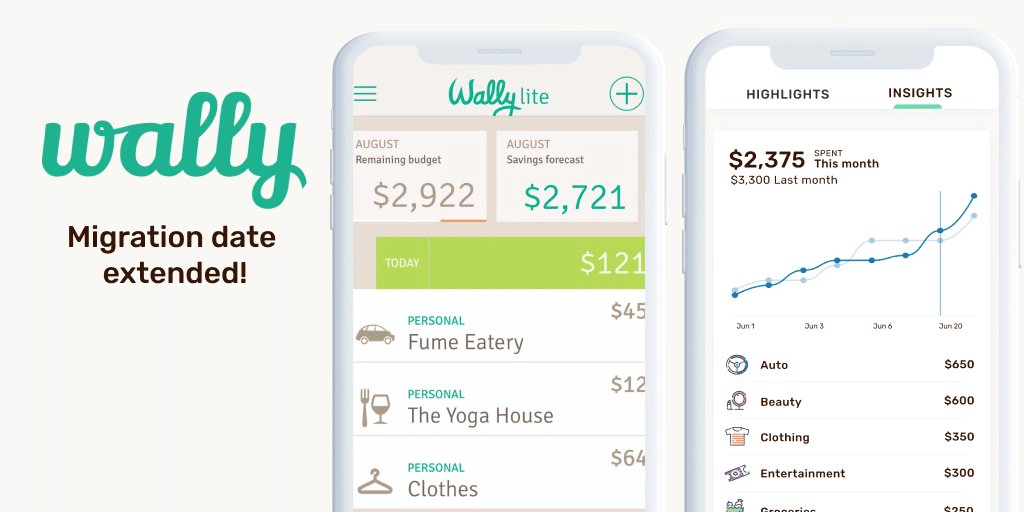

6. Wally

Wally focuses on helping users track expenses in real time, providing a simple way to see where your money is going. You can manually enter transactions or scan receipts to stay on top of your spending habits. The app allows you to set savings goals, categorize expenses, and generate reports to analyze your financial health. Wally also features a community aspect, enabling users to connect with others for support and motivation as they work toward their financial objectives.

7. Personal Capital

Personal Capital is more than just a budgeting app; it offers a comprehensive overview of your financial situation. By linking your bank accounts, investments, and retirement accounts, you can track your net worth, analyze spending habits, and plan for retirement. The app provides powerful investment tracking tools to help you understand your asset allocation and fees. With a retirement planner that forecasts your future financial needs based on current savings and spending habits, Personal Capital is a valuable resource for long-term financial planning.

8. Honeydue

Honeydue is designed specifically for couples, making it easier to manage finances together. The app allows partners to track their money collaboratively, set shared budgets, and communicate about spending. Each partner can link their bank accounts, credit cards, and loans, providing a transparent view of the couple’s finances. With features like bill reminders, spending categories, and joint financial goals, Honeydue helps couples stay on the same page with their money management.

9. Zeta

Zeta is another budgeting app tailored for couples, blending shared and individual financial management tools. You can create shared goals, track expenses, and manage budgets together while keeping individual financial privacy intact. The app simplifies tracking of recurring bills and expenses, making it easy to plan for shared costs. With insights into spending patterns, Zeta helps couples identify areas for improvement in their financial habits, fostering healthier money management.

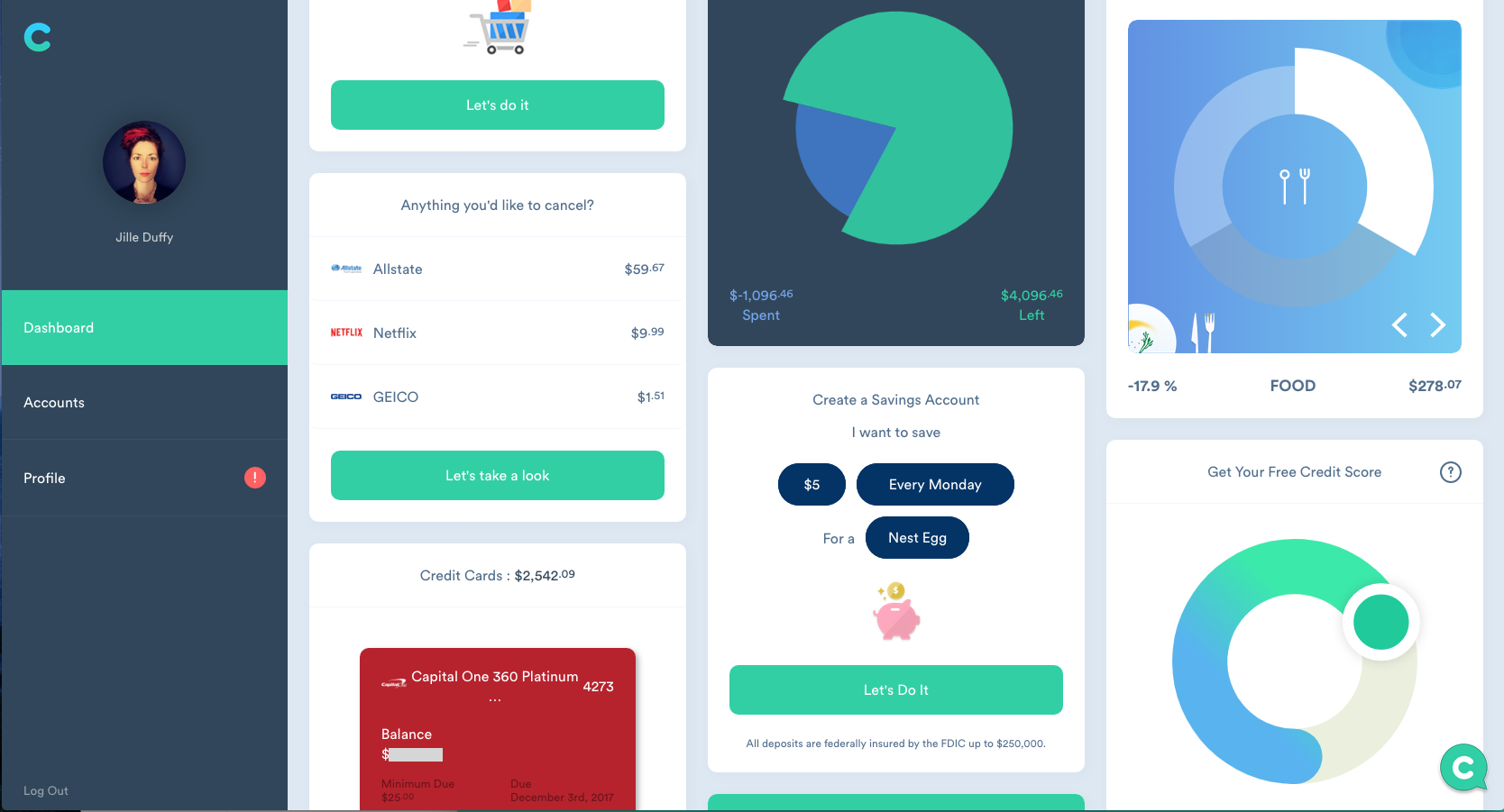

10. Clarity Money

Clarity Money focuses on helping users take control of their finances by tracking spending and managing subscriptions. The app analyzes your spending habits, categorizes transactions, and identifies opportunities to cut back. Clarity Money also allows you to cancel unwanted subscriptions directly from the app, making it easy to eliminate unnecessary expenses. With its clear visuals and user-friendly interface, Clarity Money keeps you aware of your financial situation, empowering you to make smarter spending choices.

Final Thoughts

Choosing the right budgeting tool or app can significantly impact your financial management journey. Each of these 10 budgeting tools and apps offers unique features designed to help you track spending, save money, and achieve your financial goals. Whether you prefer a straightforward app like PocketGuard or a comprehensive platform like Personal Capital, there is a budgeting solution out there to fit your needs. Take the time to explore these options and find the one that resonates with you so you can take charge of your finances and work towards a more secure financial future. With the right tools at your disposal, you can transform your approach to budgeting and turn your financial dreams into reality.

Leave a Reply