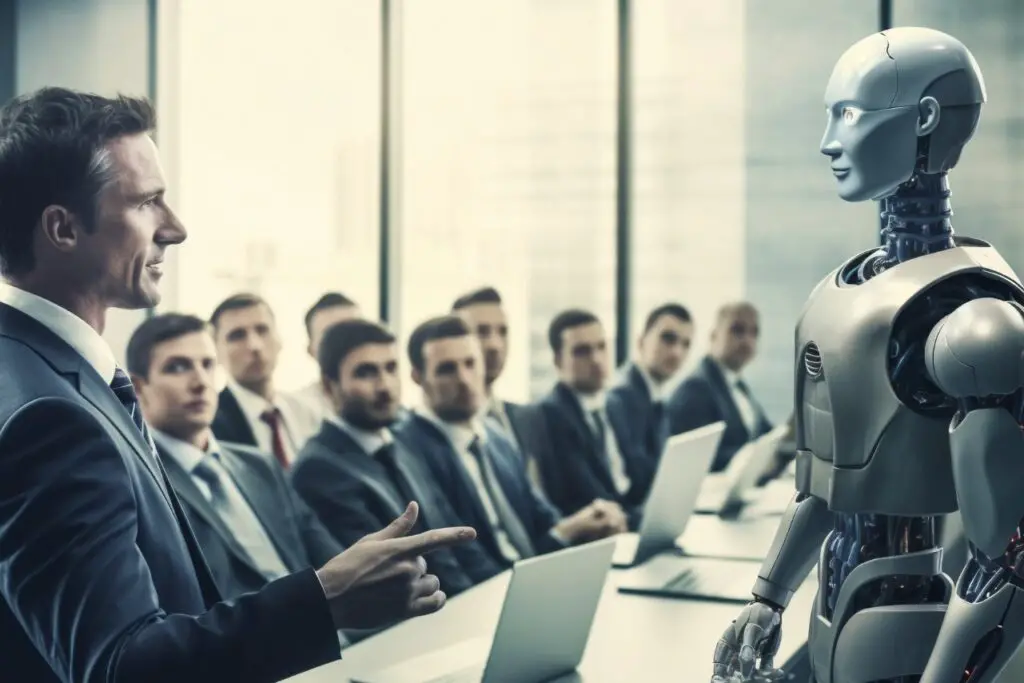

10 Intelligent Questions to Ask to Show Interest During Your Job Interview

The job interview isn’t just about answering questions—it’s also an opportunity for you to demonstrate your enthusiasm and learn about the company and role. Asking thoughtful, intelligent questions can help you stand out by showing you’re proactive, interested, and engaged. Here are 10 smart questions to ask during your interview to convey eagerness and leave a lasting impression.

1. What does success look like in this role?

This question reveals that you’re already thinking about how to excel in the position and contribute meaningfully to the company. By asking about success metrics, you show a focus on results and an understanding of the company’s priorities. It also gives you a clearer idea of what will be expected of you if you’re hired.

2. What are the most immediate challenges the team is facing?

By asking this, you demonstrate that you’re not only eager to contribute but also aware that every job comes with its difficulties. It shows that you’re solution-oriented and want to be prepared to help the team overcome obstacles from day one.

3. Can you describe the company culture?

While this might seem like a common question, it’s one that shows you’re thinking about how you’ll fit within the team and the company’s broader environment. A candidate who is concerned with culture is someone who’s thinking long-term, signaling that you’re serious about finding the right mutual fit.

4. How do you support the development of your employees?

This question indicates that you’re committed to continuous learning and professional growth. Employers appreciate candidates who are eager to evolve, and by asking this, you show that you’re interested in a company that invests in its employees’ future.

5. What are the company’s goals for the next year, and how does this role contribute to them?

Asking about the company’s goals demonstrates a broader understanding of how your role fits into the organization’s overall mission. It shows that you’re not just thinking about your tasks but also about how you can help move the company forward. This positions you as someone with a strategic mindset.

6. What are the next steps in the interview process?

Asking about the next steps demonstrates your interest in the position and eagerness to move forward. It also allows you to understand the timeline for hiring decisions, helping you manage your expectations.

7. How do you measure and reward success in this role?

This shows you’re already thinking about how you can perform at your best and what metrics the company values. Additionally, it gives you insight into the performance evaluation process and what kind of recognition or advancement opportunities exist within the organization.

8. Can you tell me about the team I would be working with?

Understanding the team structure and dynamics is essential for assessing how well you would fit in. This question shows that you value collaboration and are interested in building relationships with your future colleagues.

9. What skills or experiences do you think are most important for success in this role?

By asking this, you demonstrate your willingness to align your skills and experiences with the company’s expectations. It also allows you to assess how well your background fits the role and identify areas for growth.

10. What do you enjoy most about working here?

This question can help you learn about the positive aspects of the company from an insider’s perspective. It also creates a personal connection and can lead to a more engaging conversation.

Final Thoughts

When you ask thoughtful, intelligent questions during an interview, you not only gain valuable information about the job and the company, but you also show that you’re invested in the opportunity. These seven questions help you highlight your eagerness, preparation, and desire to succeed, ensuring you leave a strong impression on your potential employer. By approaching the interview as a two-way conversation, you position yourself as someone who is proactive, curious, and ready to contribute meaningfully to the organization.