7 Common Health Issues in Your 50s and How to Prevent Them

Reaching your 50s often brings a renewed focus on maintaining health and well-being. However, it is also a time when certain health issues become more prevalent. Knowing what to expect and how to prevent these concerns can help you stay active, healthy, and happy as you age. Here are seven common health issues in your 50s and simple steps you can take to prevent them.

1. Heart Disease

Heart disease is one of the leading health concerns for individuals in their 50s, largely due to a combination of genetics, lifestyle, and age-related changes. Conditions such as high blood pressure, high cholesterol, and obesity increase the risk of heart attacks and strokes. Prevention starts with regular cardiovascular check-ups to monitor heart health. A heart-healthy diet rich in fruits, vegetables, and whole grains is essential. Aim for at least 150 minutes of moderate exercise each week, which can include activities like walking, swimming, or cycling. Additionally, managing stress through practices such as yoga or mindfulness can have positive effects on heart health. Avoiding smoking and limiting alcohol intake also play critical roles in keeping your heart in good condition. Early detection of heart-related issues through routine checkups is key to prevention.

2. Osteoarthritis

Osteoarthritis, the most common form of arthritis, becomes more noticeable in your 50s due to wear and tear on joints over time. This condition can cause pain, stiffness, and a decrease in mobility, particularly in the knees, hips, and hands. Preventing or minimizing osteoarthritis involves maintaining a healthy weight to reduce strain on the joints. Staying physically active is crucial, as it keeps the joints flexible and helps maintain muscle strength. Low-impact exercises like swimming, cycling, or walking are excellent choices that provide cardiovascular benefits without stressing the joints. Strengthening the muscles around the joints through resistance training can also help provide better joint support and alleviate pain. Staying hydrated and eating foods rich in omega-3 fatty acids, such as fatty fish and walnuts, can further support joint health. Regular visits to a healthcare provider for evaluations can help track joint health and identify issues early on.

3. Type 2 Diabetes

The risk of developing type 2 diabetes increases as you age, especially if you lead a sedentary lifestyle or have a poor diet. Being overweight or having a family history of diabetes can heighten this risk significantly. Prevention starts with adopting a balanced diet low in refined sugars and processed foods. Focus on whole foods, including plenty of vegetables, lean proteins, and whole grains. Regular physical activity, such as walking, swimming, or participating in fitness classes, can improve insulin sensitivity and help manage weight. Aim for at least 150 minutes of moderate exercise each week. Additionally, monitoring your blood sugar levels regularly and scheduling routine checkups can help catch early signs of diabetes. If you have prediabetes, work closely with a healthcare provider to develop a personalized prevention plan that includes dietary changes and lifestyle modifications.

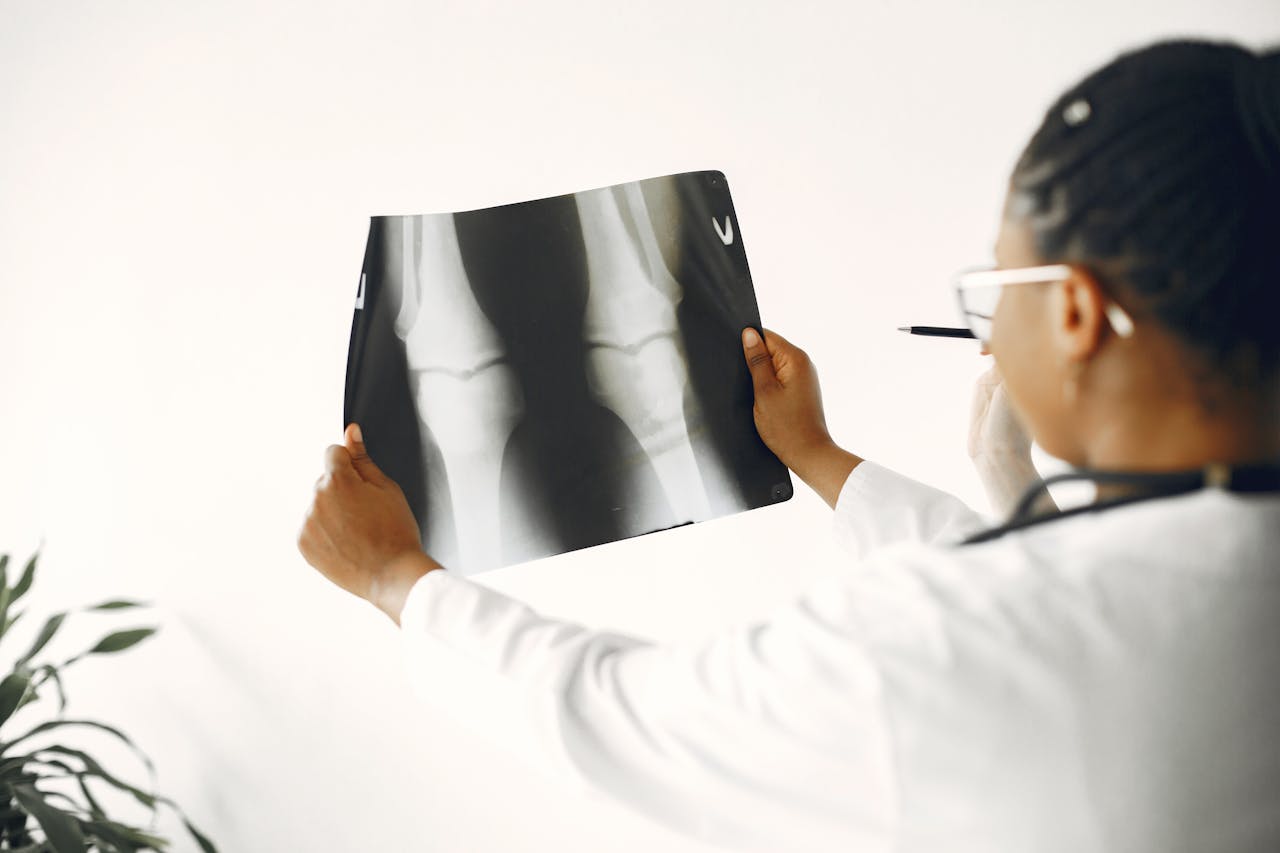

4. Osteoporosis

Osteoporosis is another common health issue in your 50s, particularly among women after menopause. This condition causes bones to become brittle and weak, increasing the risk of fractures. To prevent osteoporosis, it is vital to maintain a diet rich in calcium and vitamin D, which are essential for bone health. Dairy products, leafy greens, and fortified foods are excellent sources of calcium, while exposure to sunlight helps your body produce vitamin D. Weight-bearing exercises, such as walking, hiking, and strength training, strengthen bones and reduce the risk of bone density loss. Regular bone density screenings can help detect osteoporosis early, allowing for timely intervention. Limiting caffeine and alcohol consumption can also help maintain bone density. If you have a family history of osteoporosis, it is especially important to discuss your risk factors with your healthcare provider and develop a proactive plan to protect your bones.

5. Vision Problems

As you enter your 50s, vision problems such as presbyopia (difficulty focusing on close objects), cataracts, and age-related macular degeneration (AMD) become more common. These conditions can significantly impact your quality of life if left unchecked. Preventive measures include having regular eye exams, ideally every one to two years, depending on your vision and overall health. Wearing sunglasses with UV protection can help shield your eyes from harmful rays, which may contribute to cataract formation. Maintaining a diet rich in vitamins A, C, and E, as well as antioxidants like lutein and zeaxanthin, found in leafy greens and colorful fruits, can further support your eye health. Limiting screen time and giving your eyes frequent breaks can also reduce strain and support long-term vision. If you notice any significant changes in your vision, consult an eye care professional promptly to discuss potential treatments or corrective lenses.

6. Hearing Loss

Age-related hearing loss, or presbycusis, can start to manifest in your 50s, making it harder to hear high-pitched sounds or follow conversations in noisy environments. While some degree of hearing loss is natural with age, there are steps you can take to preserve your hearing. Avoid prolonged exposure to loud noises, and use ear protection when necessary, whether at concerts, around loud machinery, or when listening to music. Regular hearing tests can help detect early signs of hearing loss. If you notice difficulty in hearing, address any issues sooner rather than later with hearing aids or other treatments. Protecting your ears from noise damage is essential for preventing long-term issues. Additionally, maintaining good overall health through a balanced diet and regular exercise can support your auditory health.

7. Weight Gain

Many individuals in their 50s struggle with unintentional weight gain due to hormonal changes, a slower metabolism, and lifestyle factors. Excess weight, particularly around the abdomen, increases the risk of numerous health problems, including heart disease, diabetes, and joint issues. Preventing weight gain requires a combination of mindful eating and regular physical activity. Focus on portion control and choose nutrient-dense foods, such as vegetables, lean proteins, and healthy fats. Incorporating both cardio and strength training into your exercise routine can help maintain muscle mass, boost your metabolism, and burn calories. Aim for at least 150 minutes of moderate-intensity exercise each week, along with two days of strength training. Managing stress through activities like meditation or yoga can reduce emotional eating and improve overall well-being. Staying hydrated and getting adequate sleep are also critical components of weight management.

Final Thoughts

In your 50s, it is crucial to stay proactive about your health by making lifestyle changes that prevent common issues like heart disease, arthritis, diabetes, and osteoporosis. A balanced diet, regular exercise, and consistent medical checkups can go a long way in helping you avoid these conditions. Early detection and prevention are key to living a healthy, active life in your 50s and beyond. By staying informed and taking small steps now, you can protect your body and enjoy the benefits of good health well into the future. Remember that investing in your health today pays dividends for a brighter tomorrow. Taking charge of your well-being in your 50s sets the foundation for a fulfilling and vibrant life as you continue to age gracefully.

![3. Performance and Efficiency <p>The Tesla Model Y boasts impressive performance metrics that appeal to a wide range of drivers. With instant torque and rapid acceleration, the Model Y can go from 0 to 60 mph in just a few seconds, providing a thrilling driving experience. Additionally, the Model Y offers excellent efficiency, with a range of over 300 miles on a single charge, making it a practical option for daily commutes and long road trips alike. In contrast, while the Camry is known for its reliability, it doesn’t offer the same level of excitement or efficiency.if(typeof ez_ad_units == "undefined"){ez_ad_units=[];}ez_ad_units.push([[250,250],"ourdebtfreefamily_com-large-mobile-banner-1","ezslot_14",107,"0","0", "ourdebtfreefamily_com-large-mobile-banner-1-0"]);if(typeof __ez_fad_position == "function"){__ez_fad_position("div-gpt-ad-ourdebtfreefamily_com-large-mobile-banner-1-0");} .large-mobile-banner-1-multi-107{align-items:center;border:none !important;display:flex !important;flex-direction:column !important;float:none !important;justify-content:center;line-height:0px;margin-bottom:15px !important;margin-left:auto !important;margin-right:auto !important;margin-top:15px !important;max-width:100% !important;min-height:250px;min-width:250px;padding:0;text-align:center !important;}</p> ::Pexels](https://www.ourdebtfreefamily.com/wp-content/uploads/2024/10/pexels-theidahoan-2480315.jpg)