10 Ways to Avoid Overspending on Food While Traveling

Traveling can be an exciting and enriching experience, but it can also come with a hefty price tag. One of the areas where many travelers overspend is food. Between dining out at trendy restaurants, grabbing quick snacks, and indulging in local delicacies, food costs can quickly add up. Fortunately, there are plenty of ways to keep your food budget in check while still enjoying the local cuisine and making the most of your trip. Here are 10 practical tips to help you avoid overspending on food while traveling, ensuring that you can enjoy your trip without breaking the bank.

1. Plan Your Meals Ahead of Time

One of the most effective ways to avoid overspending on food is to plan your meals ahead of time. Before you arrive at your destination, take some time to research affordable dining options in the area. Look up local markets, street food vendors, and inexpensive restaurants that offer authentic cuisine. Planning ahead can help you avoid impulsive decisions when hunger strikes, preventing you from falling into the trap of expensive touristy restaurants. By having a rough idea of where and what you’ll eat, you can set a realistic food budget and stick to it.

In addition to planning where to eat, consider mapping out your meals for the day. This will help you avoid unnecessary spending by ensuring that you are not tempted to grab expensive snacks or meals on the go. You can even plan to have a larger meal during lunchtime, which is often more affordable, and then enjoy a lighter dinner. By setting clear expectations for your meals, you will have more control over your spending.

2. Cook Your Own Meals

While dining out is part of the travel experience, cooking your own meals can be a great way to save money. Many accommodations, such as hostels, Airbnbs, or vacation rentals, come equipped with kitchen facilities. Taking advantage of these kitchens allows you to prepare simple, home-cooked meals, which can be much more affordable than eating out for every meal. You can visit local markets or grocery stores to pick up fresh ingredients, and prepare meals that suit your taste and dietary preferences.

Cooking your own meals doesn’t have to be complicated. Even if you’re not a seasoned chef, you can easily prepare quick and easy meals like sandwiches, salads, pasta, or stir-fries. Having the ability to cook your own food also gives you more flexibility and control over your meal schedule. You can prepare breakfast or lunch in advance, saving both time and money while exploring the local area.

3. Use Food Delivery Apps Wisely

Food delivery apps have become increasingly popular, offering convenience and access to local restaurants. However, it’s important to use these apps wisely to avoid overspending. While ordering food through apps like Uber Eats, DoorDash, or Grubhub can be convenient, it often comes with additional service fees and delivery charges that can add up quickly. To save money, look for special deals or promotions that these apps often offer, such as discounts for first-time users or free delivery on select orders.

Another way to save money is by ordering directly from local restaurants rather than through third-party services. Many restaurants charge higher prices when using delivery apps, so ordering directly can help you save money. Additionally, you may be able to pick up your food directly from the restaurant, saving on delivery fees altogether.

4. Avoid Tourist Traps

When you’re traveling, it’s easy to fall into the trap of eating at touristy restaurants that are located near major attractions. These places often cater to tourists and charge inflated prices for food that may not be as high-quality or authentic as local options. To avoid overspending, try to venture a little farther from the main tourist areas. Explore neighborhoods where locals eat, and you’ll often find more reasonably priced and authentic dining experiences.

If you’re unsure where to go, ask locals for recommendations. They can point you to hidden gems that are not only affordable but also offer a true taste of the local cuisine. You can also use apps like Yelp, TripAdvisor, or Google Reviews to find highly-rated, budget-friendly restaurants. Eating like a local not only saves you money but also enhances your travel experience.

5. Embrace Street Food

Street food is one of the best ways to enjoy authentic local flavors without breaking the bank. In many countries, street food is not only delicious but also incredibly affordable. Whether it’s tacos in Mexico, bánh mì in Vietnam, or falafel in the Middle East, street food offers a wide variety of options that are both tasty and budget-friendly. Street vendors often offer freshly prepared meals at a fraction of the price you’d pay at a sit-down restaurant.

When choosing street food, it’s important to be mindful of food safety. Make sure the vendor is busy, which often indicates that the food is fresh. Look for clean preparation areas, and if possible, choose vendors that cook food in front of you to ensure its quality. Street food can be a great way to immerse yourself in the local culture while keeping your food costs low.

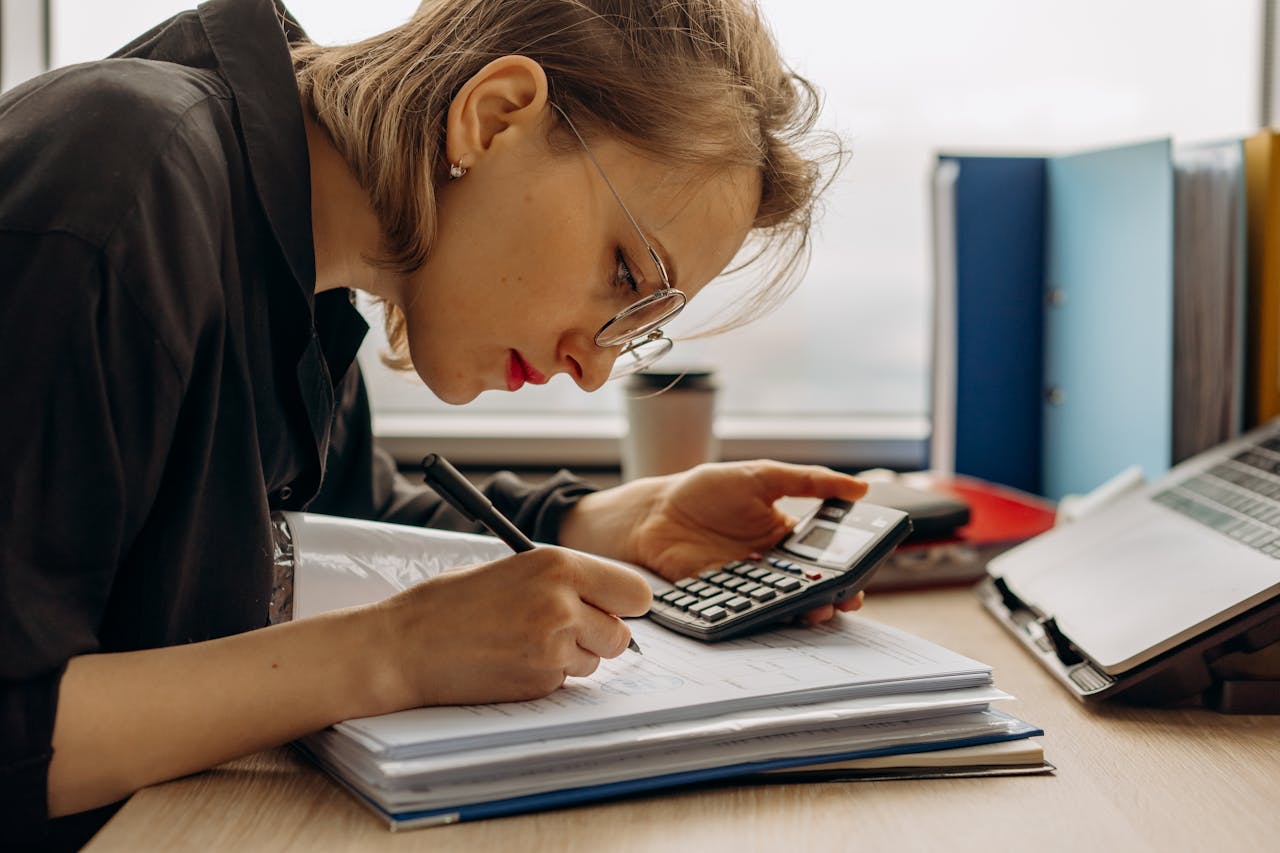

6. Stick to a Food Budget

Setting a daily food budget is a simple but effective way to ensure that you don’t overspend on food while traveling. Before your trip, determine how much you’re willing to spend on food each day. This will help you allocate your resources and make conscious decisions about where and what to eat. Having a clear budget in mind can also help you prioritize spending on experiences that are more important to you, such as a special meal or a food tour.

If you find that you’re spending more than expected on one day, try to balance it out by eating more affordably the next day. For example, if you splurge on a fancy dinner, you can save money by preparing a simple breakfast or lunch the following day. Keeping track of your food expenses will help you stay within your overall travel budget.

7. Take Advantage of Free Breakfasts

Many hotels, hostels, and vacation rentals offer free breakfast as part of the accommodation package. This is a great opportunity to save money on one of the most important meals of the day. Even if the breakfast is simple, it can provide you with a solid start to the day, helping you avoid the temptation to buy expensive snacks or meals on the go. Some places offer more substantial breakfasts with options like eggs, fruit, bread, and pastries, which can also serve as a light lunch later in the day.

If your accommodation doesn’t offer a free breakfast, consider visiting a local café or bakery for a quick and inexpensive meal. Many cafés offer affordable breakfast options like pastries, coffee, and fruit, which can help you fuel up without overspending.

8. Shop at Local Grocery Stores

Shopping at local grocery stores is another great way to save money on food while traveling. Whether you’re looking for ingredients to cook your own meals or simply need snacks for the day, grocery stores often offer better prices than convenience stores or tourist shops. You can buy fresh produce, bread, cheese, and other staples to create your own meals or pack a picnic for day trips.

Shopping at local markets can also be an enjoyable experience, as you’ll get a chance to see the local food culture and try new ingredients. Many destinations have vibrant farmers’ markets where you can find fresh, seasonal produce at affordable prices. By shopping at grocery stores and markets, you can save money and have more control over what you eat.

9. Avoid Expensive Airport or Train Station Meals

Airport and train station meals are often overpriced, with limited options and inflated prices. Whether you’re grabbing a quick bite before your flight or waiting for a train, these meals are rarely a good value. To avoid overspending, try to eat before you arrive at the airport or station. If you’re already at the airport, consider packing snacks or a meal from a local grocery store or restaurant to take with you.

If you must buy something at the airport or train station, opt for smaller snacks or drinks rather than a full meal. Many airports and stations now have convenience stores where you can find affordable snacks like sandwiches, fruits, or yogurt.

10. Drink Water Instead of Sugary Beverages

When dining out, it’s easy to add sugary sodas, juices, or alcoholic drinks to your meal, but these beverages can quickly inflate your food bill. Instead, opt for water, which is often free or very inexpensive. Drinking water is not only a healthier choice, but it can also save you a significant amount of money during your trip. If you’re craving something more exciting, consider carrying a refillable water bottle and refilling it at water fountains or local cafes.

In some countries, tap water is safe to drink, while in others, bottled water may be necessary. Either way, drinking water instead of sugary beverages can help you stay hydrated, save money, and maintain your energy levels throughout the day.

Final Thoughts

Food is an essential part of any travel experience, but it doesn’t have to be a major expense. By planning your meals ahead of time, cooking your own food, embracing street food, and using food delivery apps wisely, you can enjoy the local cuisine without overspending. Avoiding tourist traps, shopping at local grocery stores, and sticking to a food budget will further help you keep your food costs under control. With these practical tips, you can savor the flavors of your destination while staying within your budget, making your travel experience even more enjoyable and stress-free.